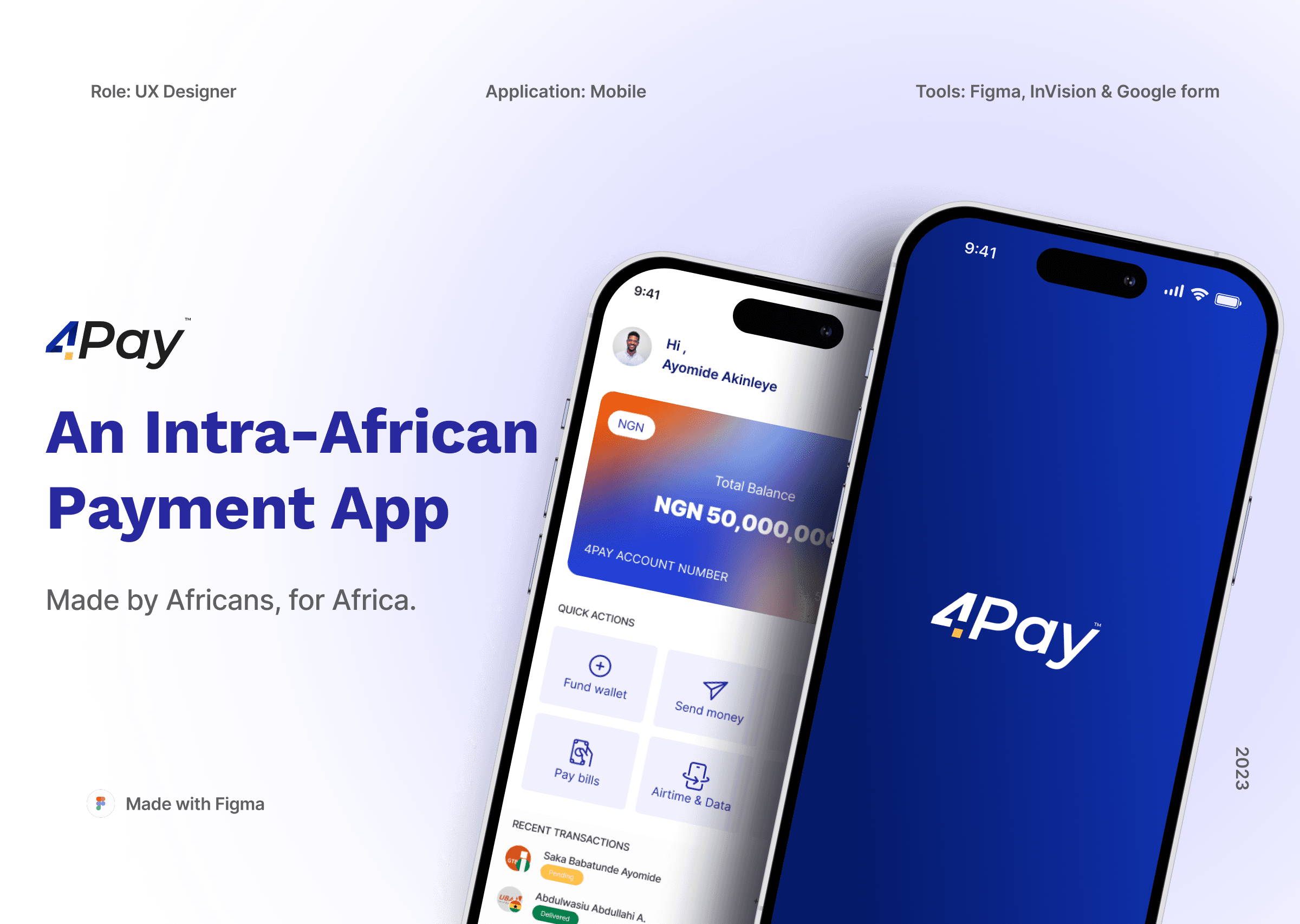

Send and receive

money between African countries with ease.

Business Goal

The business goal for this App is to enable a user from an African country to send money to another user in a different African country seamlessly

Problem Statement

it is impossible to send money from One African Bank to Another

To do so, the money needs to be converted to USD ( dollars). This has been a problem because it means over usage of the USD which is foreign exchange. For this reason, the African finance Cooperation and African Union came up with the Pan African Payment and Settlement System (PAPSS), an infrastructure that can help to facilitate intra-African payment.

About the Project

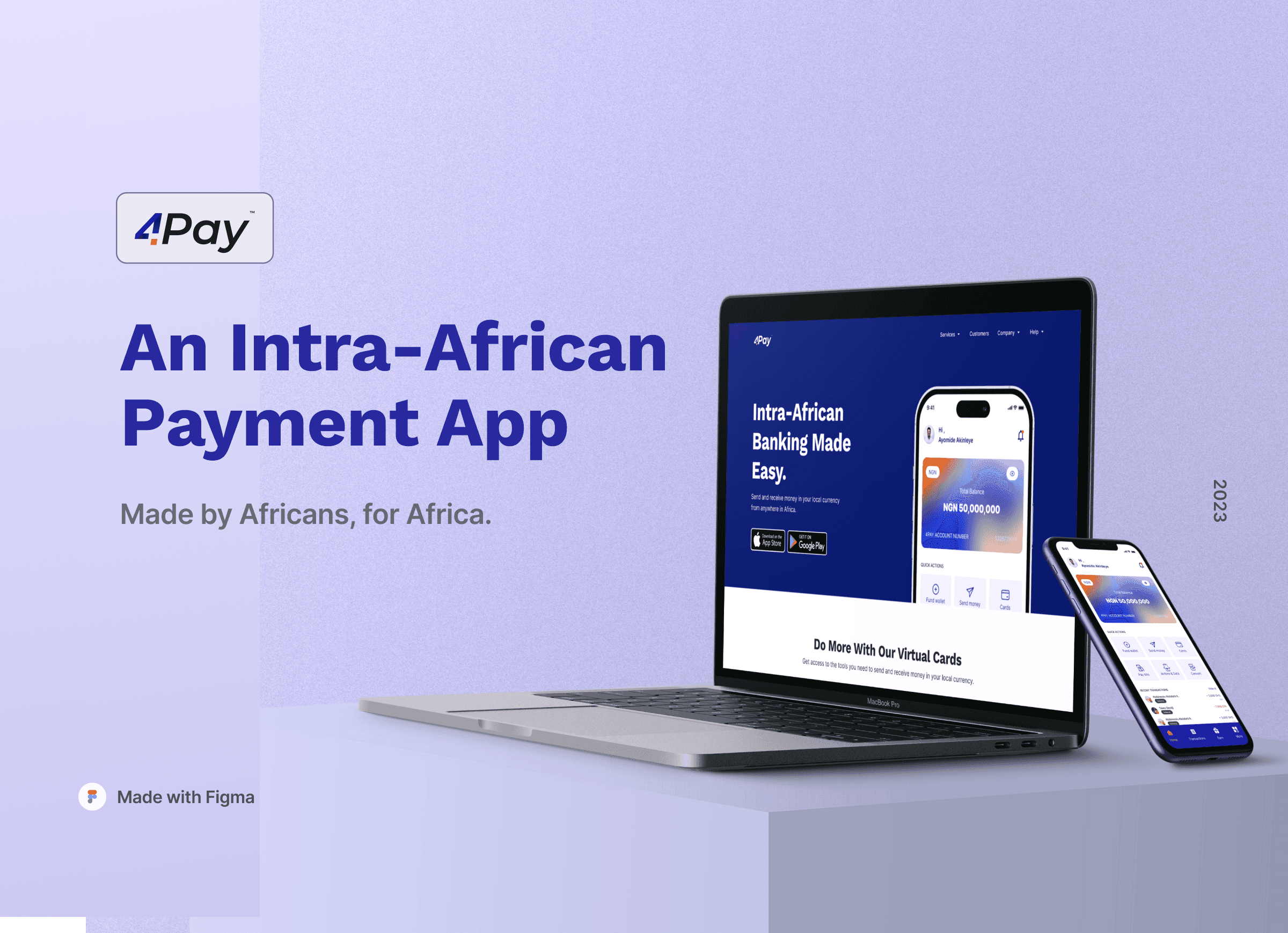

An Intra Africa payment App

This product is an online payment platform that facilitates payments for individuals and businesses across Africa.

Proposed Solution

Develop a payment application that facilitates seamless money transfers between African countries.

The proposed solution is to come up with a payment application that will enable users to facilitate seamless money transfers between African countries, allowing users to send funds effortlessly. Minimising foreign exchange, transaction rate and slow processes.

By simplifying intra-African payment transfers, our app aims to enhance financial connectivity and convenience across the continent.

Send and receive

money between African countries with ease.

About the Project

An Intra Africa payment App

The UX Design Process

The UX Design Process

In order for us to be able to solve our users’ problem effectively, we incorporated the Design Thinking process.

Empathise

In the first phase of our design process, we empathized with our user through Observation and Immersion. We went online (App store and Play store) to observe the reviews and comments of our competitors. We also downloaded the apps and used it.

Define

After we have analysed our competitors, we proceeded to user persona creation to map out the behaviours and needs of our target audience and we came up with a problem statement

Ideate

After establishing the problem we wanted to solve, we created a story of the user’s problem. To come up with ideas, we launched a brainstorming session. We came up with a flow to solve each idea and created moodboards.

Prototype

In this stage, we created a comprehensive style guide for our designs. We represented our ideas digitally by creating low-fidelity wireframes and high-fidelity designs

Competitive Analysis

In the first phase of our design process, we empathized with our user through Observation and Immersion. We went online (App store and Play store) to observe the reviews and comments of our competitors. We also downloaded the apps and used it.

Weaknesses

Strength

Eversend

Weaknesses

Strength

Payday

Use of dollar card for international purchase

Fast onboarding

Fast transaction

Use of dollar card for international purchase

Fast onboarding

Fast transaction

Longer time to receive OTP

High rates

Card Funding

Only one option for receiving OTP

Uploading Funds (too slow)

Support Team not responsive

High exchange rates

Live chat not responsive

High Minimum Transfer Limit

Using the SWOT Analysis Framework

We analyzed the market and the big players in the market. We came up with a framework to help guide our research process and we used SWOT ANALYSIS to sort through core user pain points.

What are the key differentiators?

Free transfers to an Eversend account

Industry leaders being that they are one of the first Infra-African payment product.

What makes them uniquely valuable?

They offer incentives and reward programs with their “Earn” feature.

Multi-currency payments

How do their user needs overlap or differ from yours?

Faster and seamless transactions

In app conversion using PAPSS (direct conversion to the recipient’s currency)

How do they position themselves?

They offer 3 ranges of products: Money transfer, Multi-currency & currency exchange, A safe wallet account.

What do they say they offer?

They position themselves as transparent, helpful, industry leaders and safe & secure.

Who do they appear to be targeting?

They target independent individuals within the ages of 25-50yrs.

What are they doing well or badly?

No tutorials or blog posts on how money exchange works when using this app to a new user.

Empathise Phase

User Research

In the first phase of our design process, we designed an online survey with Google Forms to observe patterns and similarities in the needs of potential users. A total of 40 people responded to the Survey. Given below is the google form prepared for the User research.

Your age range?

18-28 years

29-38 years

39-48 years

49-58 years

59-68 years

73%

25%

40 responses

What is your country of residence?

Canada

Congo

Ghana

Kenya

Nigeria

Uganda

UK

0

10

20

30

1(2.5%)

1(2.5%)

2(5%)

2(5%)

2(5%)

1(2.5%)

40 responses

29(10%)

No

Yes

Is there any app that allows you to send money in your local currency?

73.7%

28.3%

38 responses

How often do you use the platform?

Very often

Sometimes

Rarely

Never

50%

27%

20%

35 responses

Poor cutomer support

High Transaction Fee

Speed

Others

What challenges do you encounter while using the app?

35 responses

12 (34%)

40%

14 (40%)

11 (31%)

1 (3%)

What is your gender?

Male

40 responses

Female

Prefer not to say

60%

30%

10%

Yes

No

40 responses

Do you send money to other African countries?

57.5%

42.5%

What is your experience with using the app?

Good

Fair

Bad

Nil

65%

19%

12%

34 responses

Good customer support

Secure

Easy to use

Swift transactions

Local currency option

Low transaction fee

What do you like most about the app?

35 responses

10 (44%)

6 (26%)

3 (13%)

2 (9%)

1 (5%)

1 (5%)

If an app was created to help you send money in your local currency to another African country, will you us it?

Yes

38 responses

No

Maybe

68.4%

28.9%

I wish I can get a lower exchange rate.

App could be better.

They should have an awesome customer support and low transaction fees.

I wish I had something that could deliver my money faster.

What does the user

Think?

It’s very easy to use and it explains everything for you.

Some are easy but not fast.

The transaction fees are high.

Speed and exchange rate is important to me while sending money.

What does the user

Say?

Gets super frustrated when payment doesn’t deliver on time.

Feels fulfilled when payment made is successfully delivered.

Gets stressed due to difficult payment process.

Gets annoyed due to poor customer support.

What does the user

Feel?

I use the app every time I need to send money to someone

App could be better.

I send money almost every week.

I send to other African countries.

I send money through mobile transfer.

What does the user

Do?

The UX Design Process

Empathy Map

The empathy map is a collaborative visualisation that maps out user behavours and needs. It consists of four shapes, which shows what the user says, does, thinks, and feels.

The UX Design Process

User Pain points

The empathy map is a collaborative visualisation that maps out user behavours and needs. It consists of four shapes, which shows what the user says, does, thinks, and feels.

I do not get confirmation when my money is been picked up

I could not get a customer support when I needed it.

My money got to the recipient too late and transaction fee was high.

The process of making payment was quite stressful.

User Persona

We proceeded to user persona creation to map out the behaviours and needs of our target audience

Jessica Boateng

Age

Location

Role

Occupation

Education

28

Ghana

General Manager

Real Estate Agent

B.Sc

Goals

Jessica would love to have a live chat on the app for technical support

To find a payment app that is fast, convenient and cost-effective

To be able to receive payments from her clients internationally without high processing fees

Description

Jessica is a dedicated Real Estate Agent that uses the Eversend to transfer funds across African countries.

Problem Statement

Slow onboarding process

The lack of function on the home site

No notification once money has been sent or received

Frustrations

Jessica has tried different payment methods which has its challenges

Those platforms have slow processing times & high transaction fees which affects her business growth

Jessica is not satisfied with the fact, that she cannot add multiple cards to her wallet

Jessica is frustrated with the Customer service department as they are “non existing”

Paul Etim

Age

Location

Role

Occupation

Education

28

Nigeria

General Manager

Real Estate Agent

B.Sc

Goals

Paul would love to have a real person to speak to in customer service and not a chat BOT

To be able to make transfers fast when he’s in these markets

To have an in app tutorial that shows or tells him how to navigate the app.

Description

Paul is a new user of Eversend, he uses the app to transfer funds to his suppliers in South Africa and Ghana .

Problem Statement

Poor customer service

Slow processing time

Too many ID verification

No onboarding tutorial which takes longer to sign up with visible steps

Frustrations

Paul is not satisfied that he can only chat with customer service, why can’t he call them?

Paul is unhappy that there are no tutorials to show him how to navigate the app.

Paul is tired of carrying cash around to these African markets, he just wants to be able to transfer at good rates

How might we simplify Infra-Africa payment transfers.

How might we help users transact at very low transaction fees?

How might we prepare a user for an emergency usage?

How might we create an incentive and rewards program for a user when they make transfers or exchange with 4Pay?

How might we simplify the sign-up & onboarding process of 4Pay?

Ideate Phase

How Might We Questions

Using HWM and jobs to be done framework as our method of ideating for solutions.

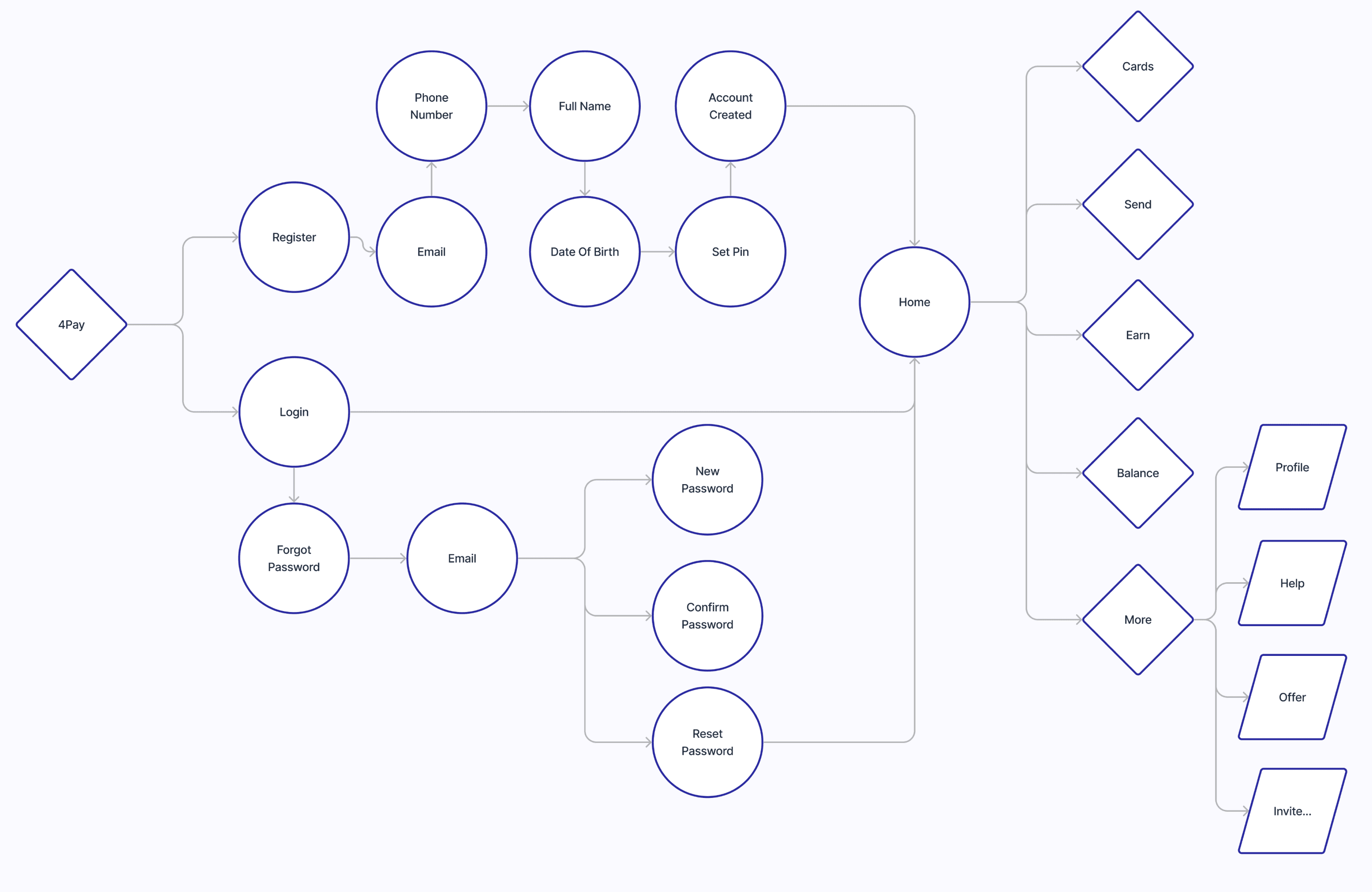

User Flow

We created a User Flow to solve each idea and created moodboards from the launch of the application to the homepage where they can carry out the app functionalities.

Pay

TM

Colour

Primary

#28289F

Secondary

#F4A301

Grey

#F4A301

White

#F4A301

Logo and Name Derivation

The name is a fusion of two words - 4 representing team 4 and pay which depicts payment (the main purpose of the app. The outcome is a name that is unique, memorable and captures what the products stands for.

Typography

Aa

Work Sans

Bold

Semibold

Regular

A B C D E F G H I J K L M N O P Q R S T U V W X Y Z

a b c d e f g h i j k l m n o p q r s t u v w x y z

1 2 3 4 5 6 7 8 9 0

Aa

Inter

Bold

Medium

Regular

A B C D E F G H I J K L M N O P Q R S T U V W X Y Z

a b c d e f g h i j k l m n o p q r s t u v w x y z

1 2 3 4 5 6 7 8 9 0

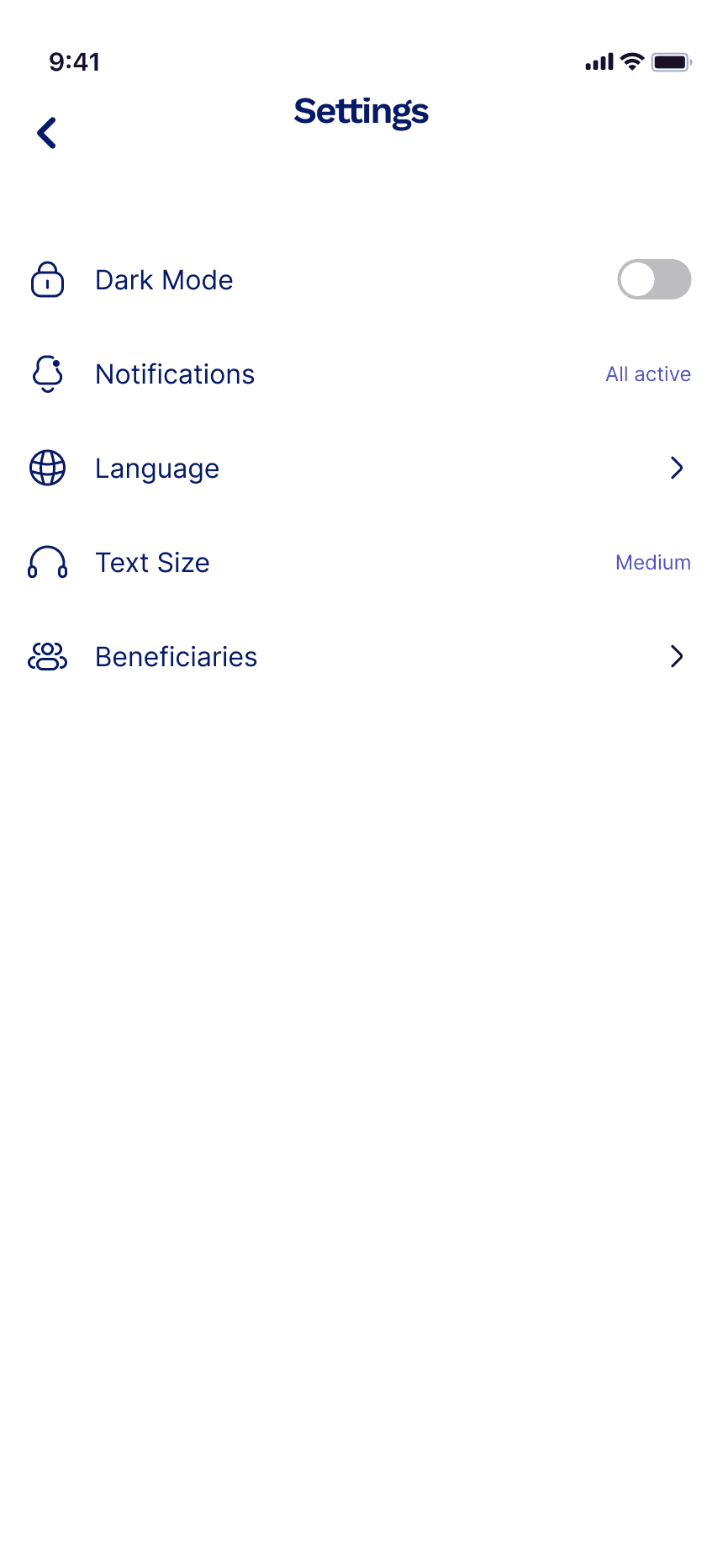

Design System

A design system saves time in iteration and changes by utilizing premade UI components and elements. It allowed for consistency in the app design.

Grid System

375px

Columns - 2

Margin - 16 px

Gutter - 24 px

Height - 8 px

Gutter - 8 px

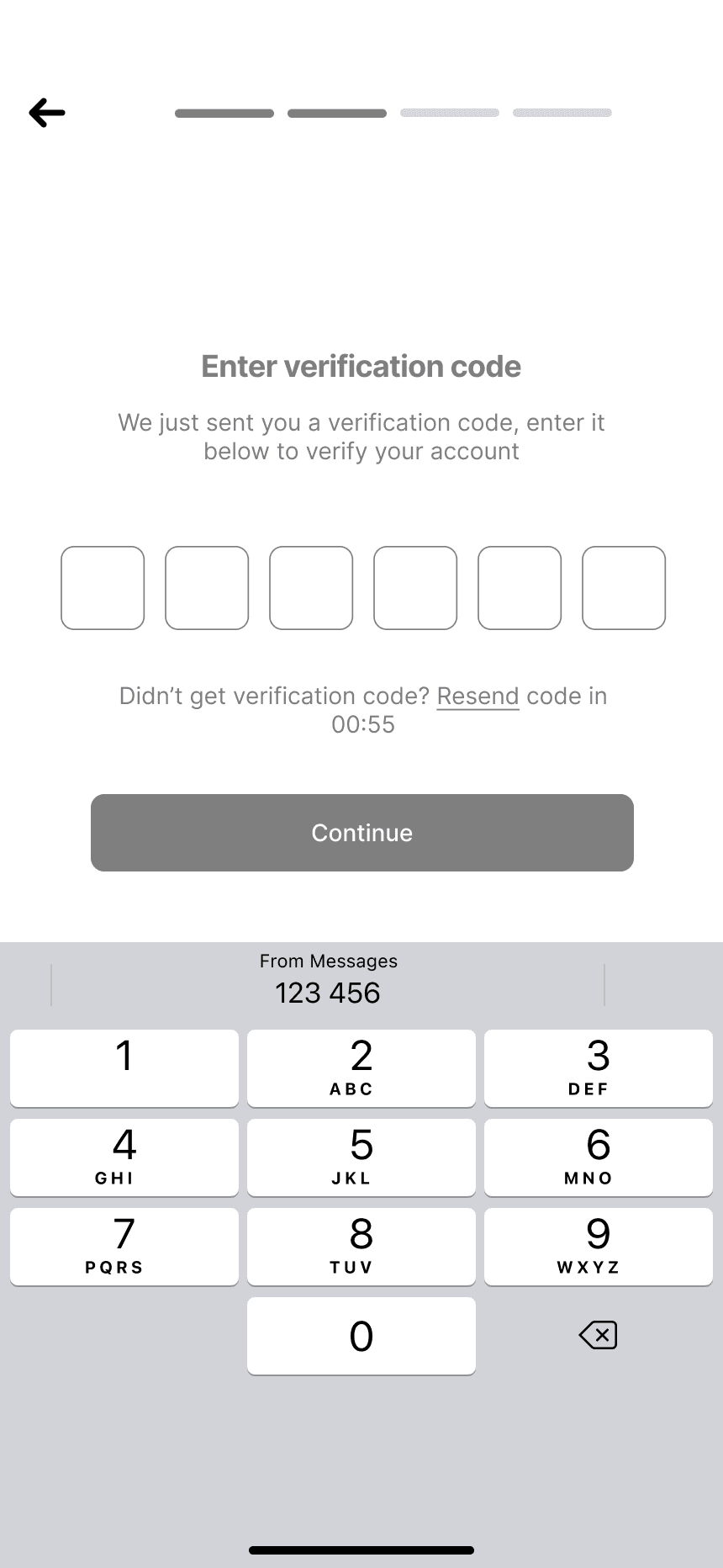

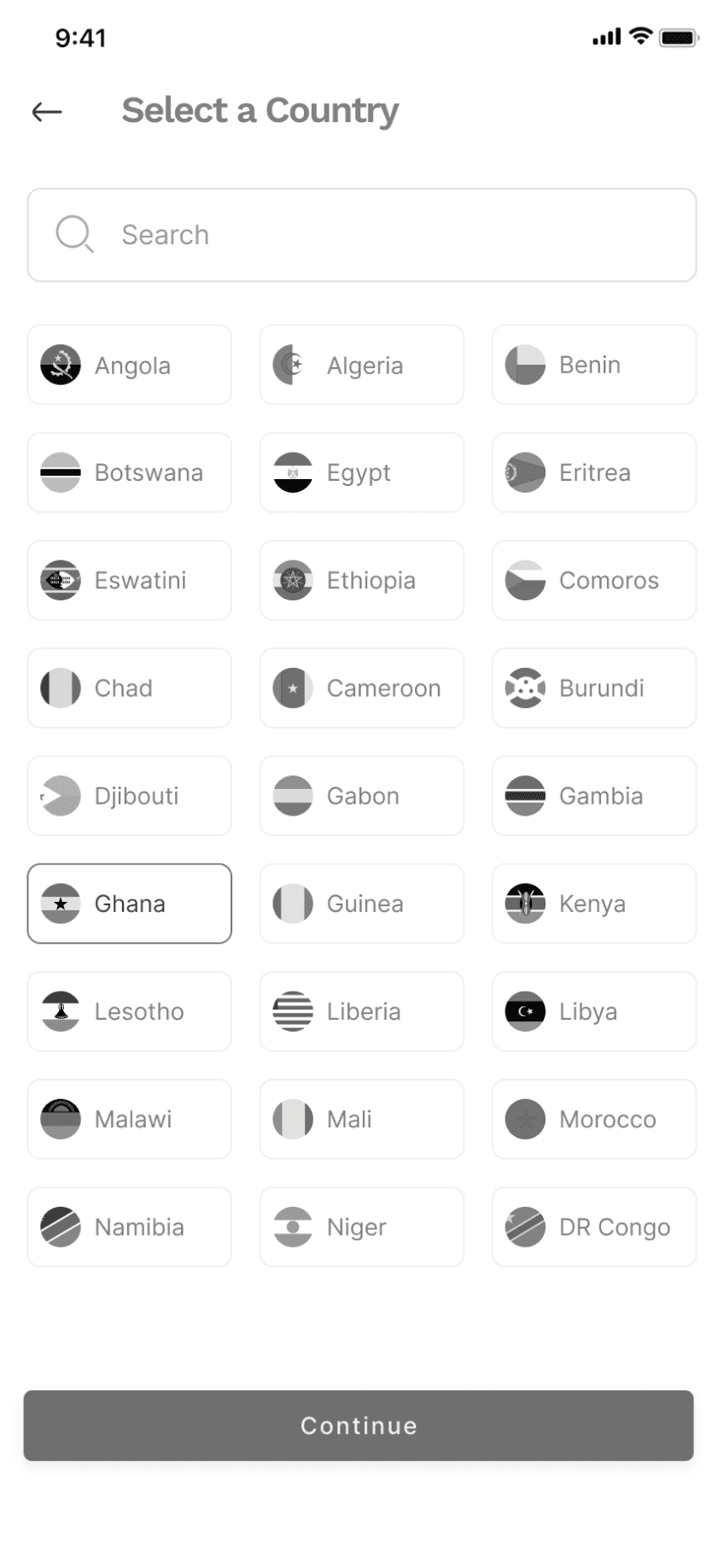

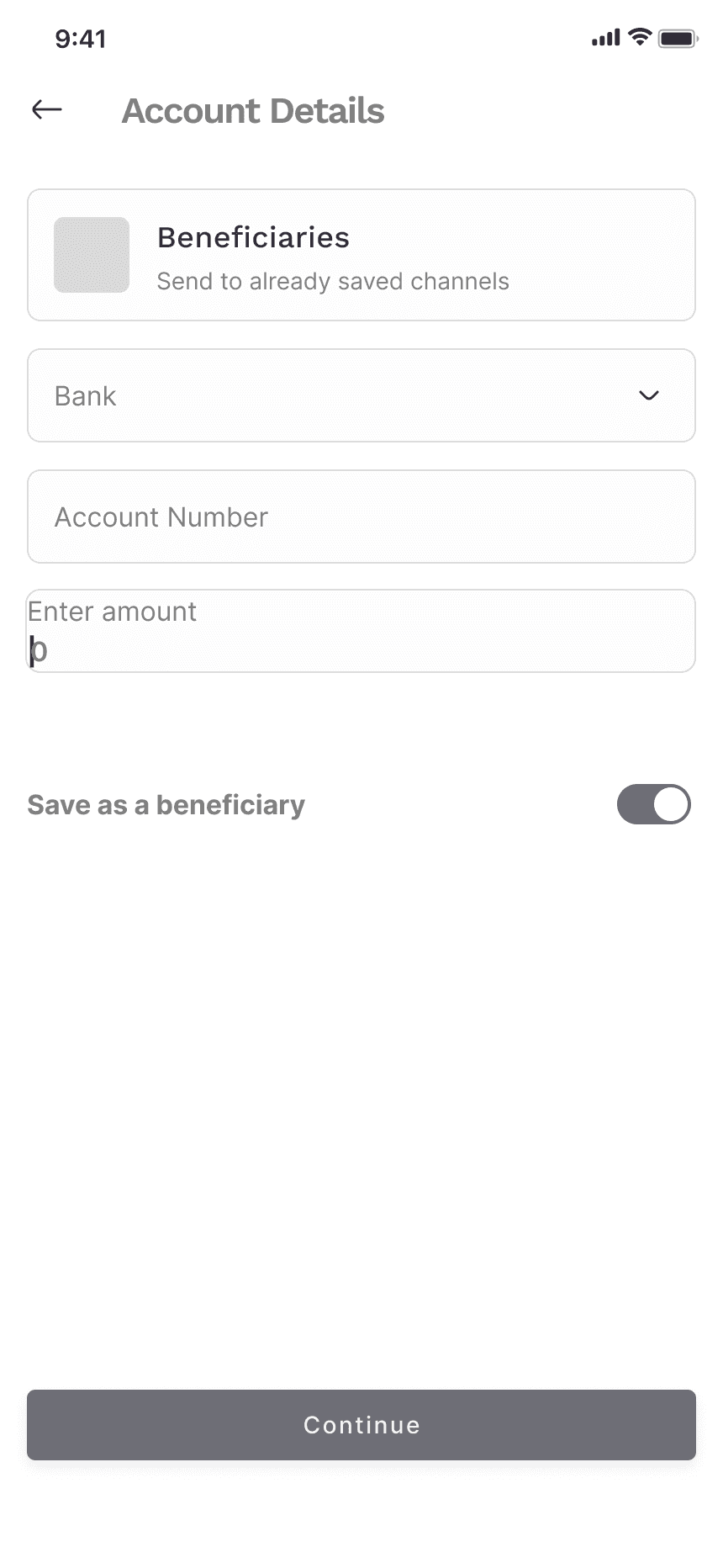

Prototype Phase

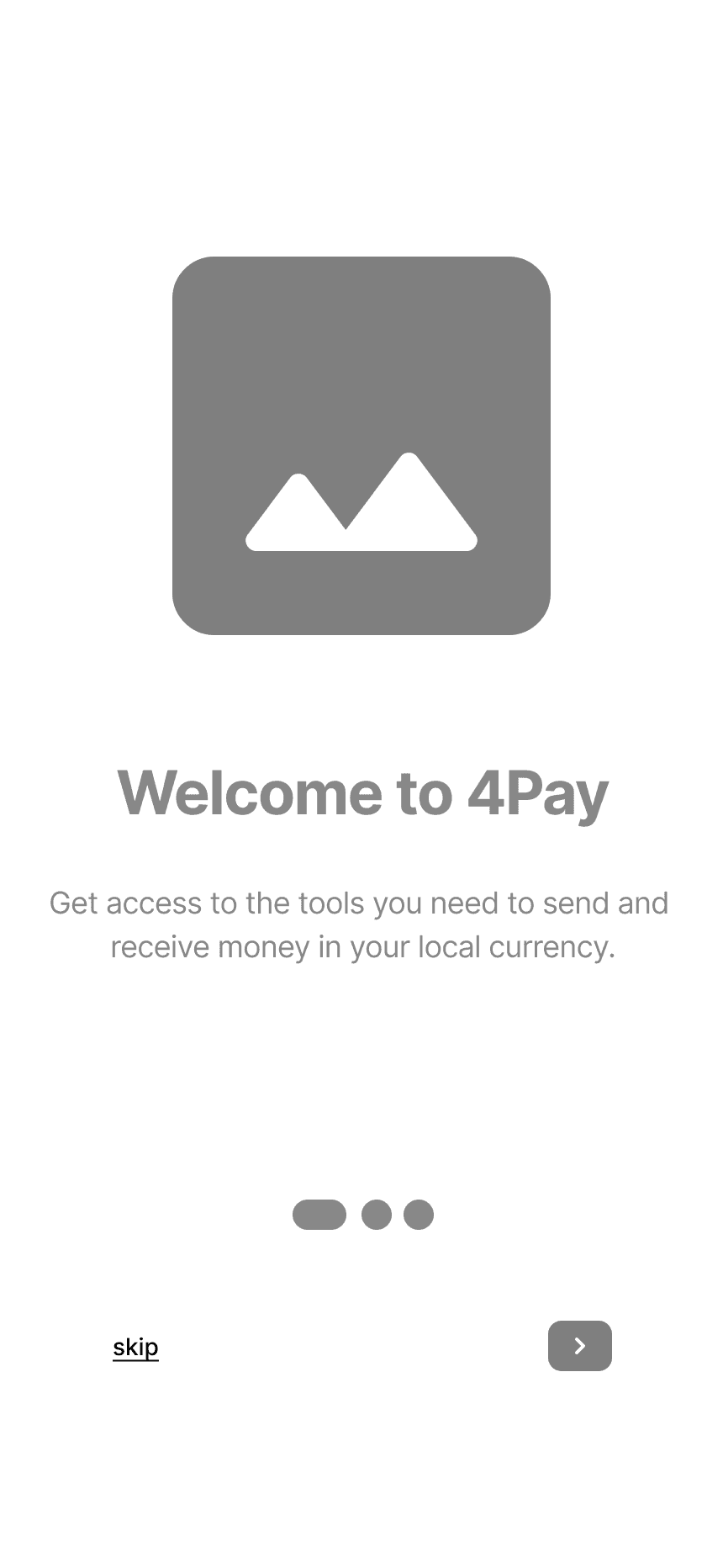

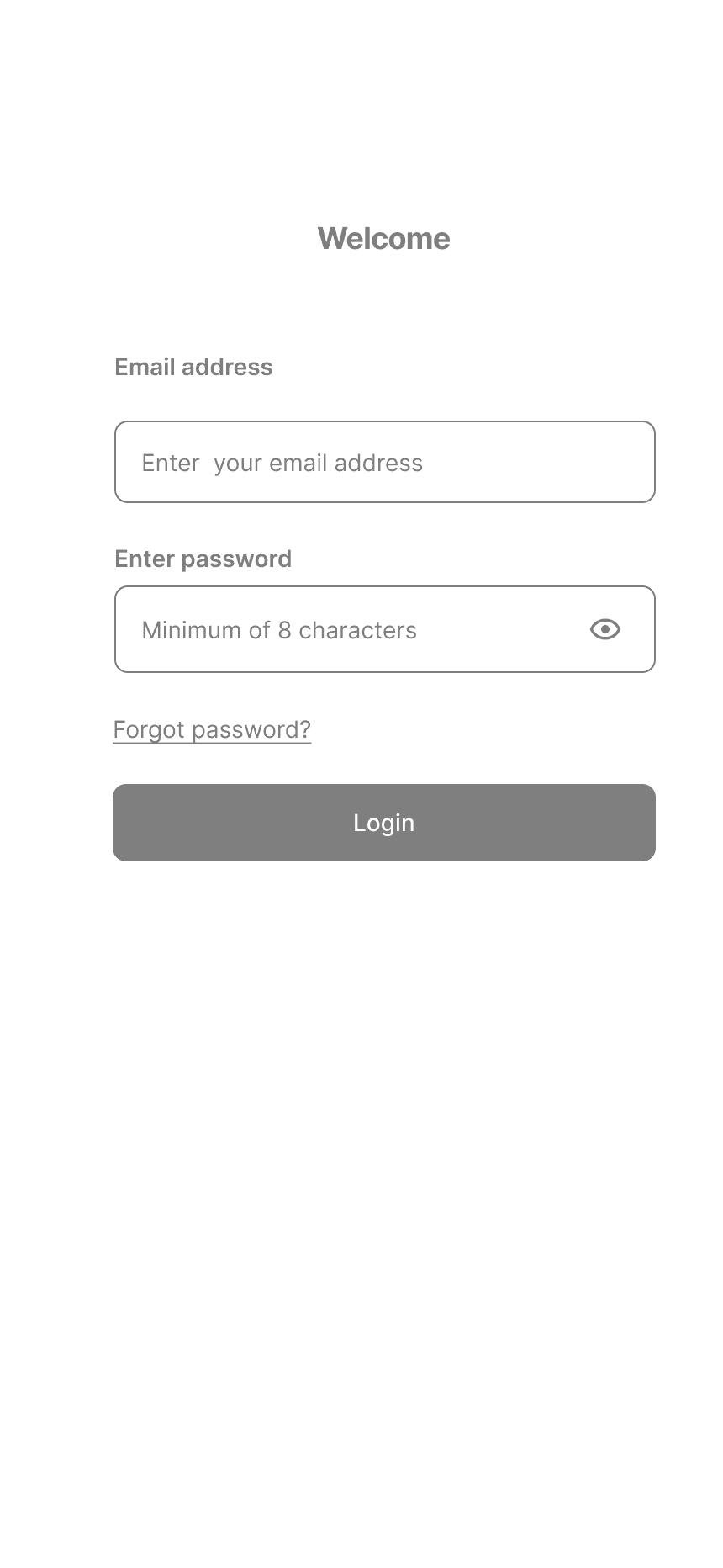

Low-Fidelity Design

After creating a design system, we began to represent our ideas digitally while demonstrating design thinking

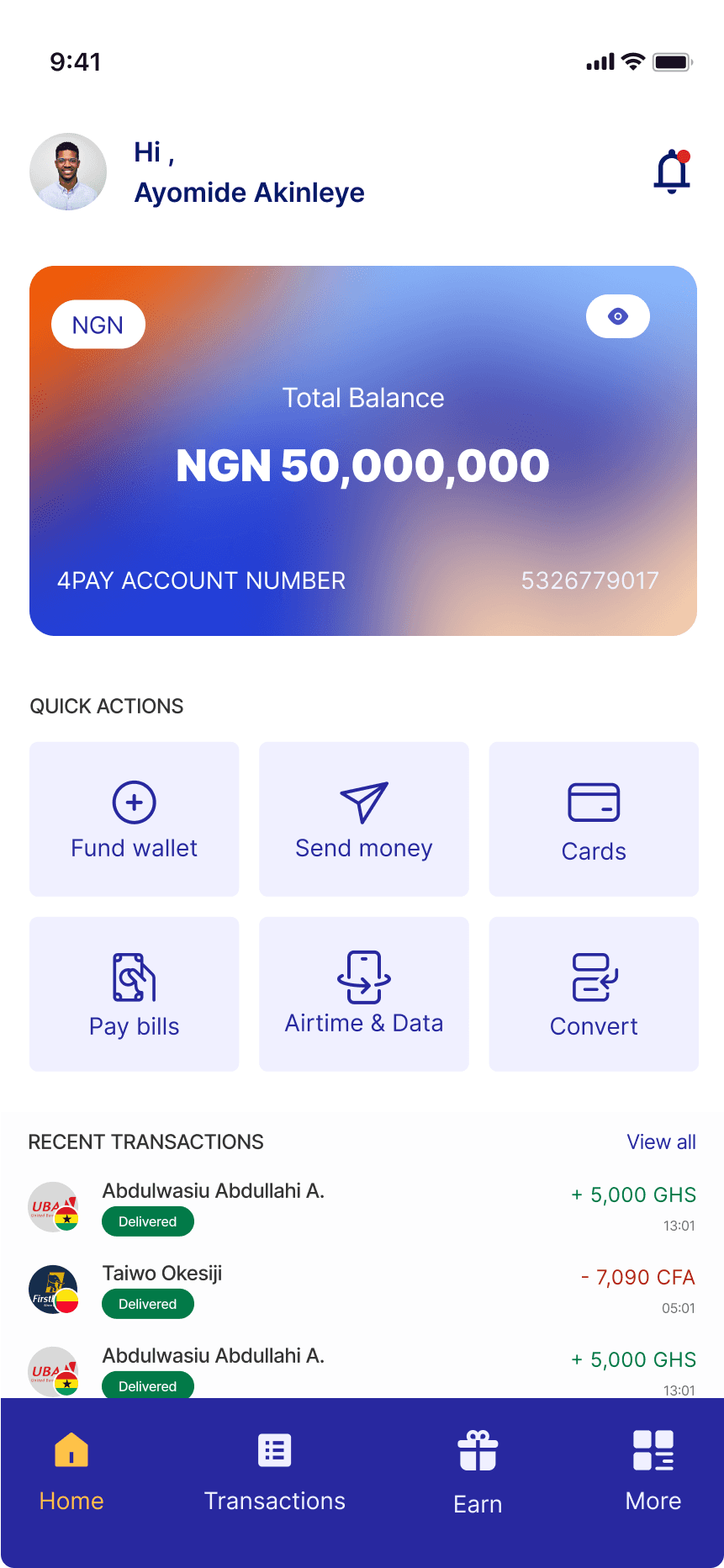

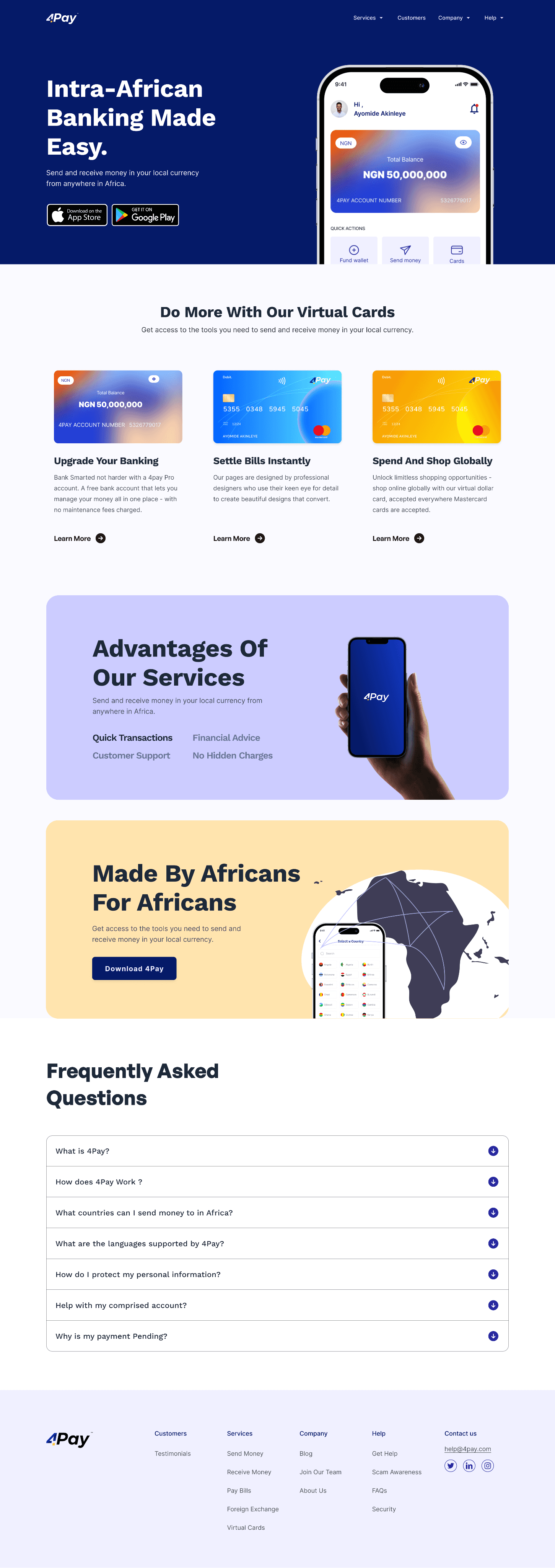

UI Design

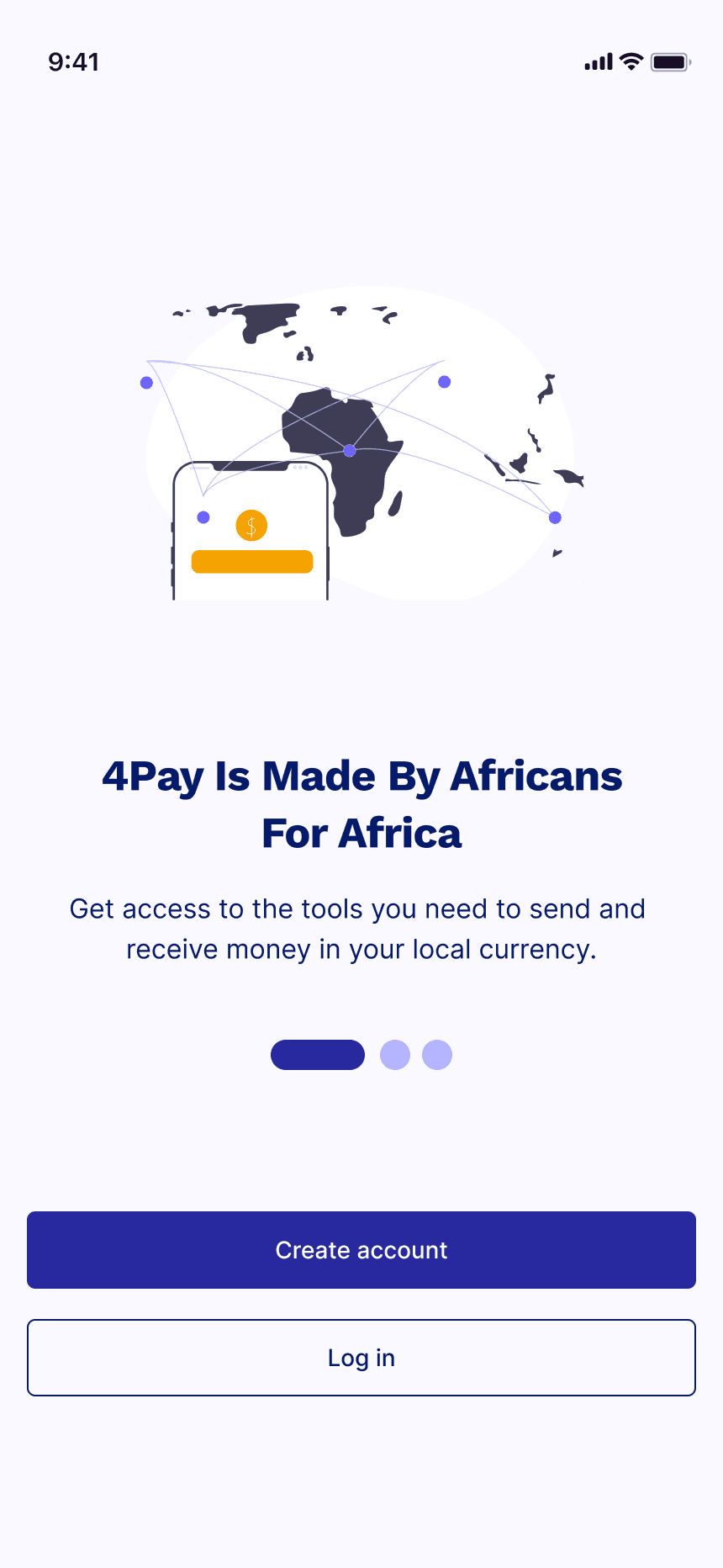

Landing page

Mobile App Design

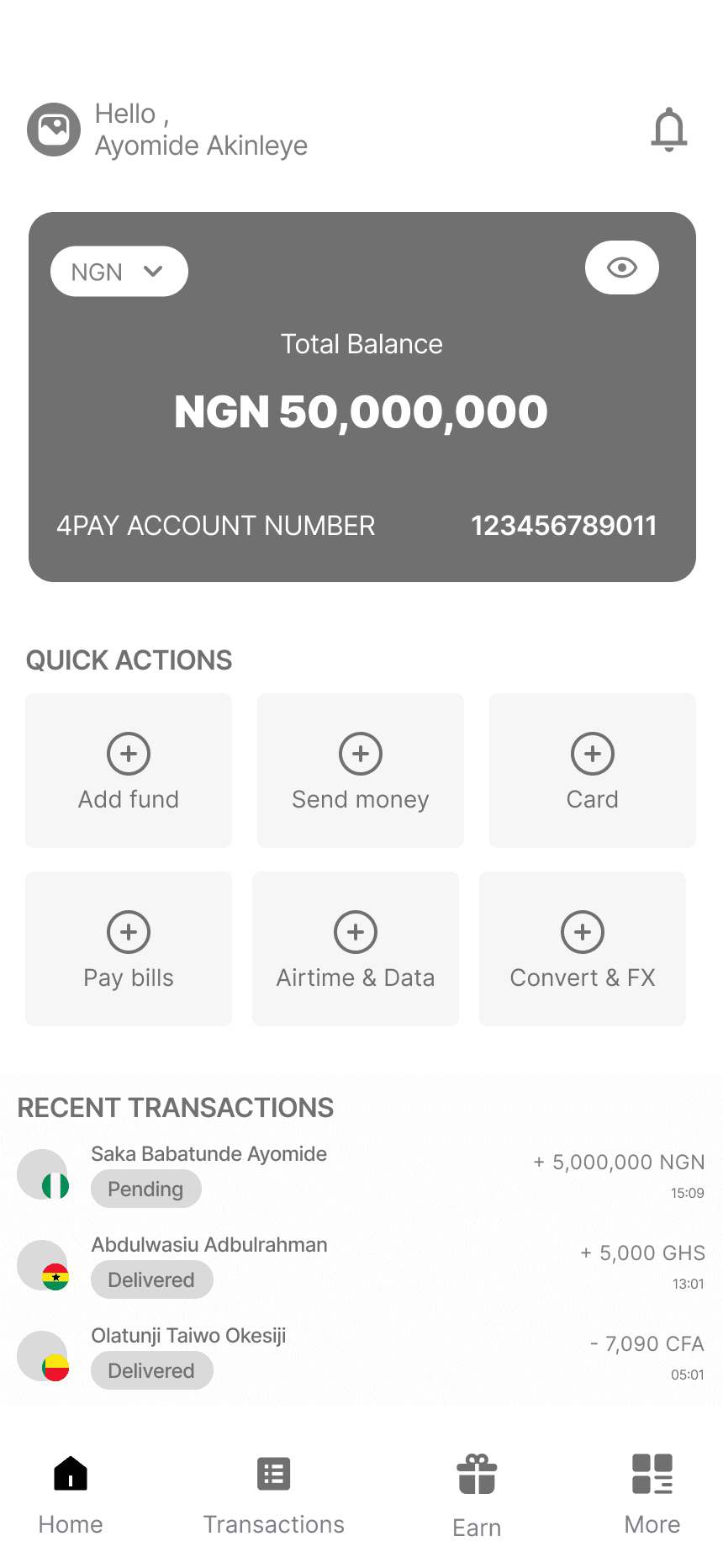

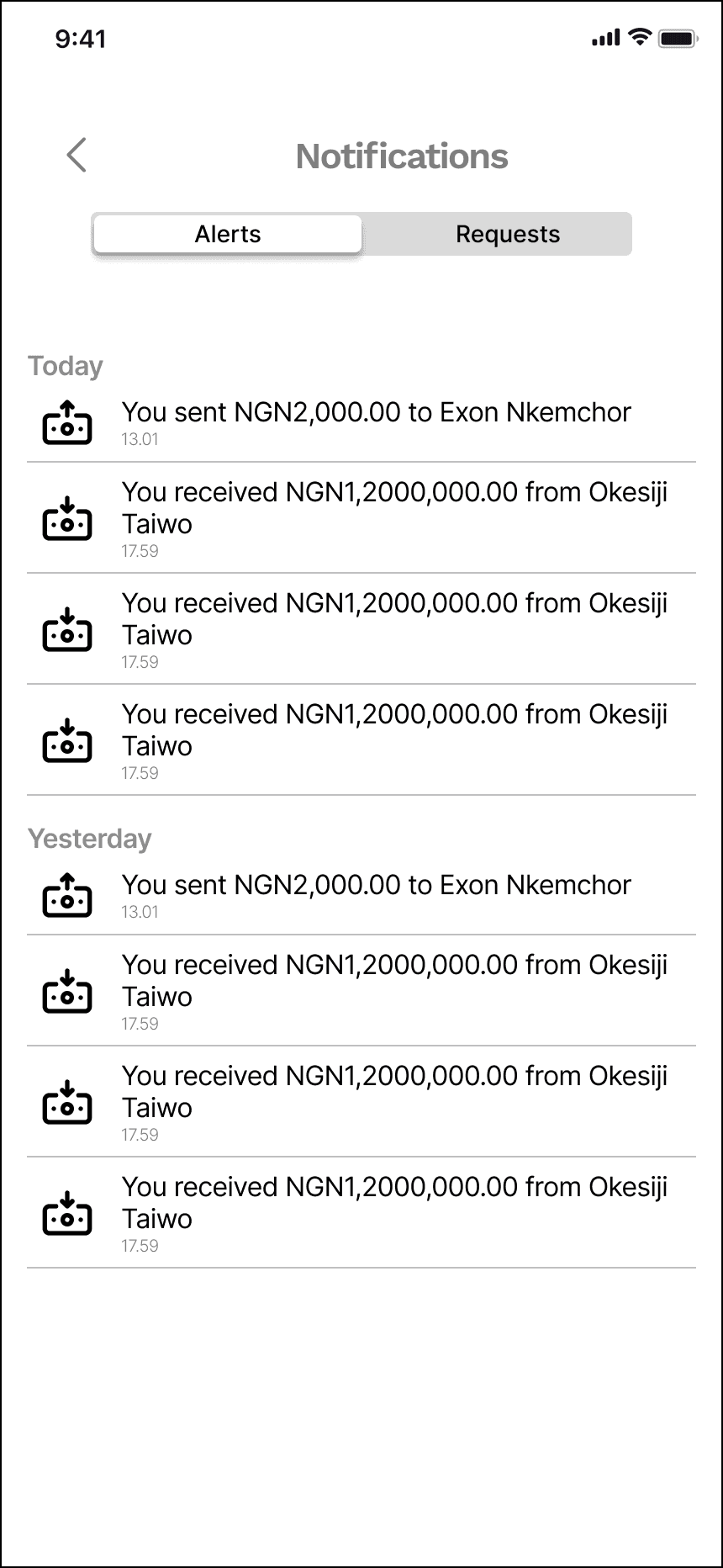

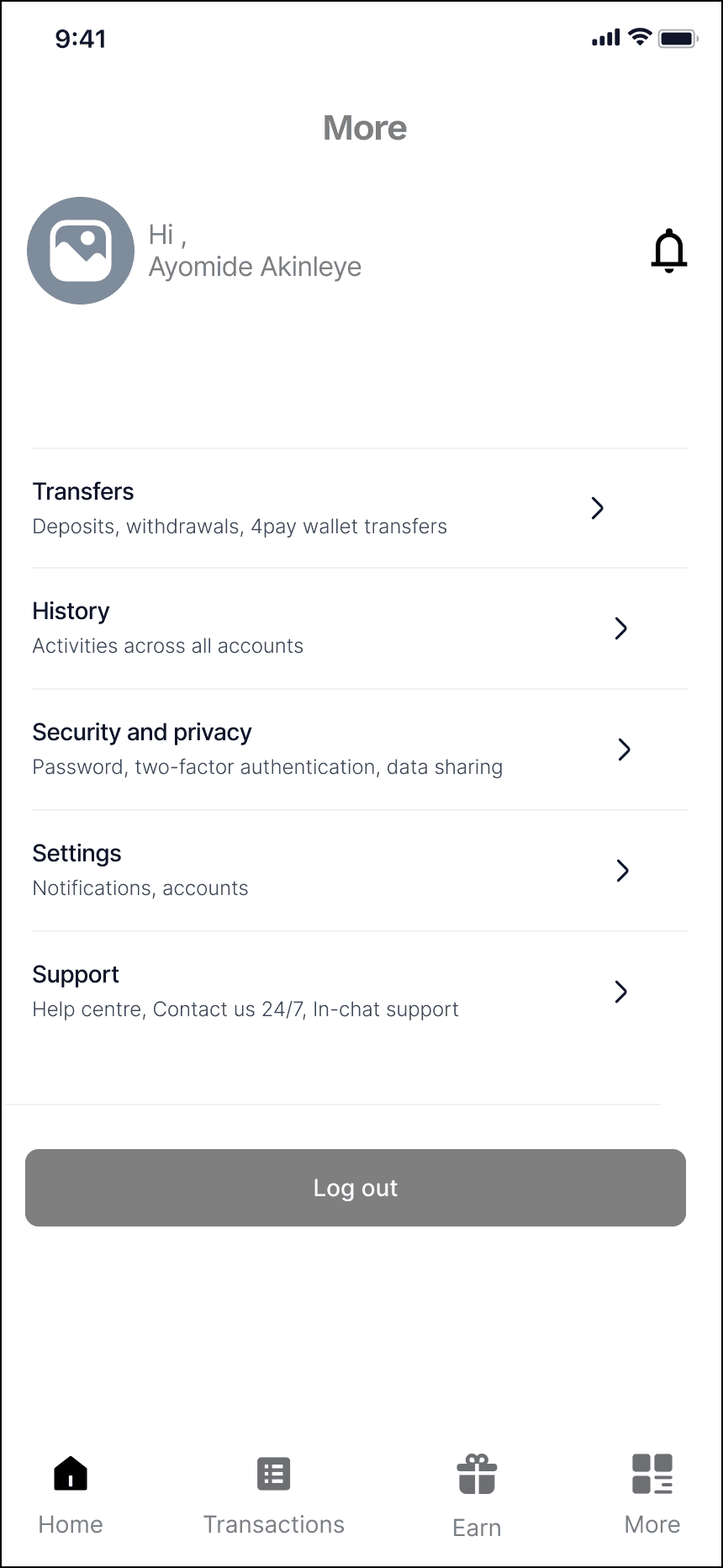

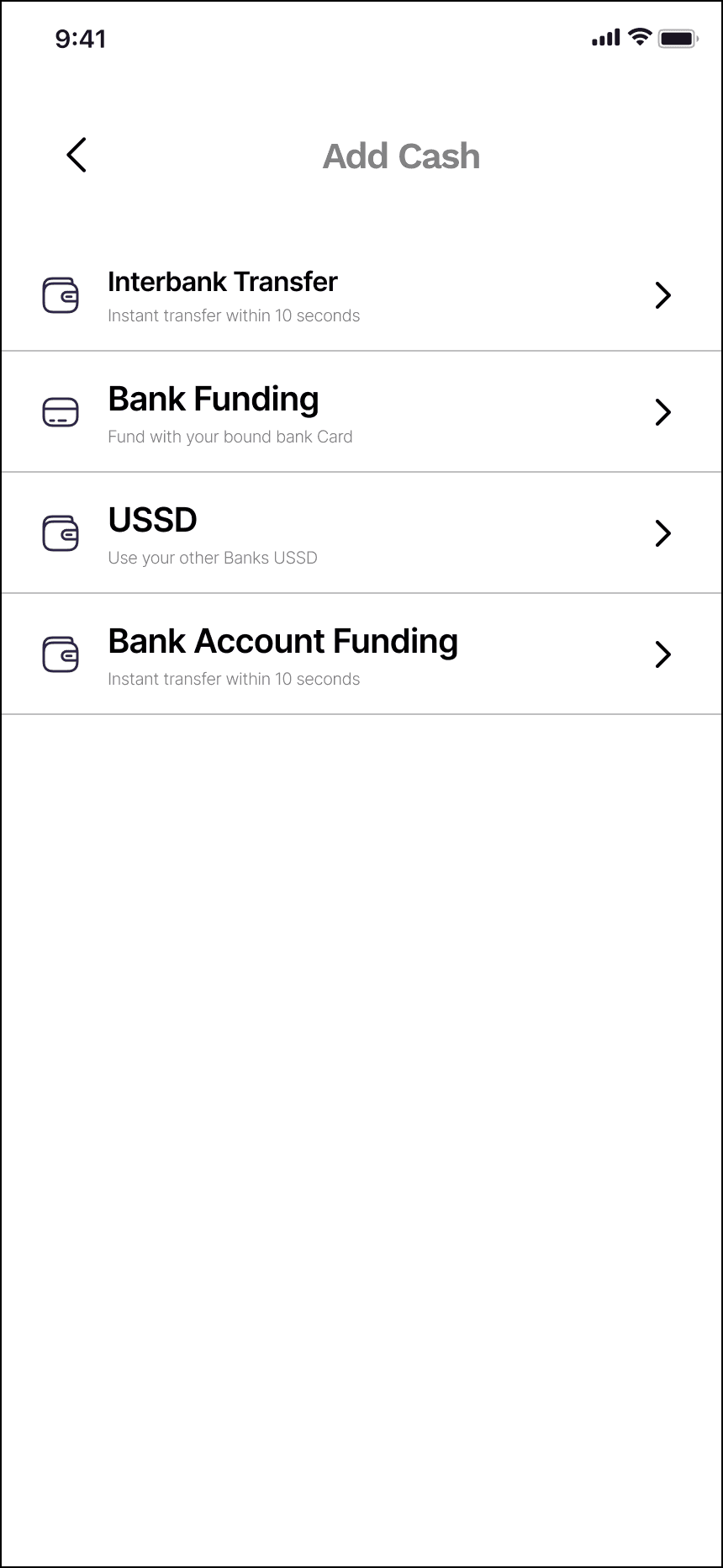

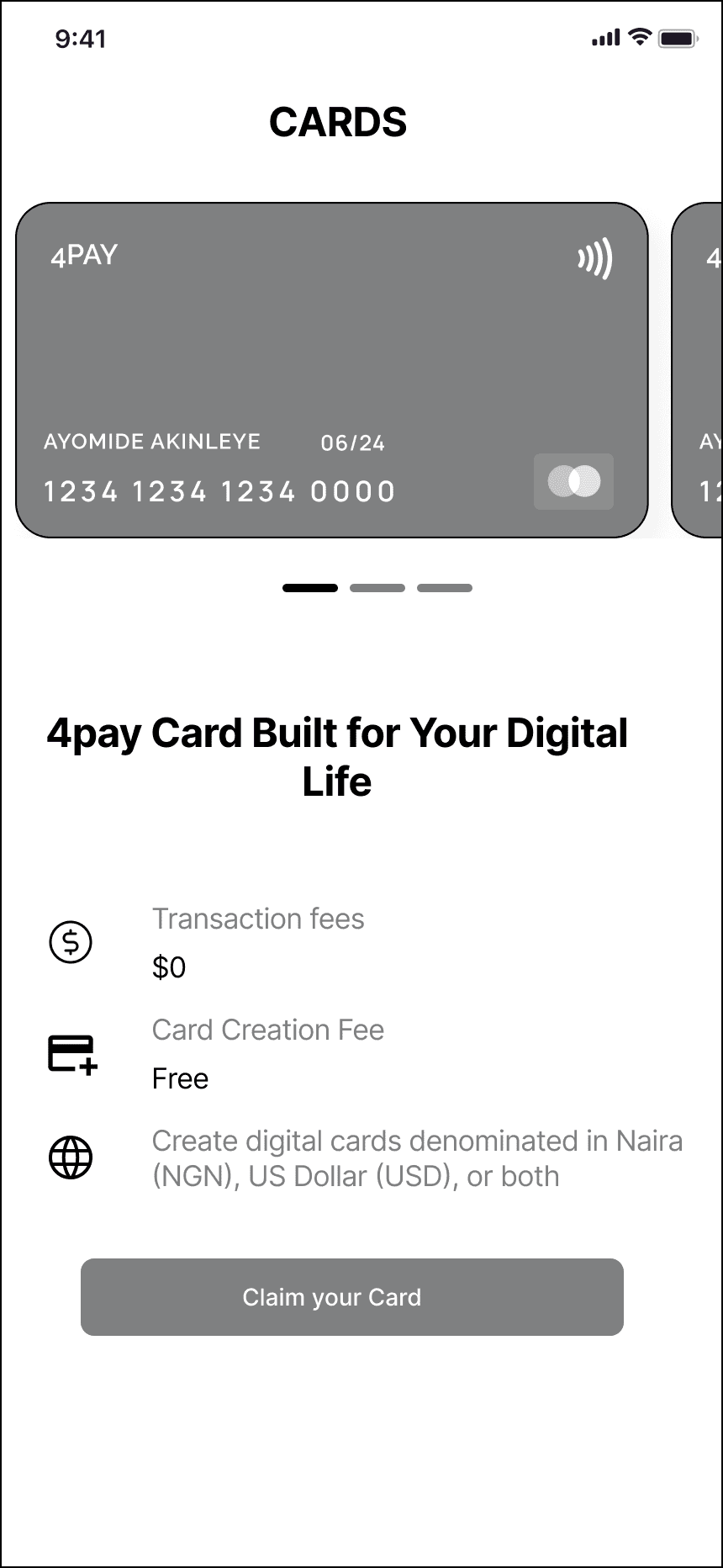

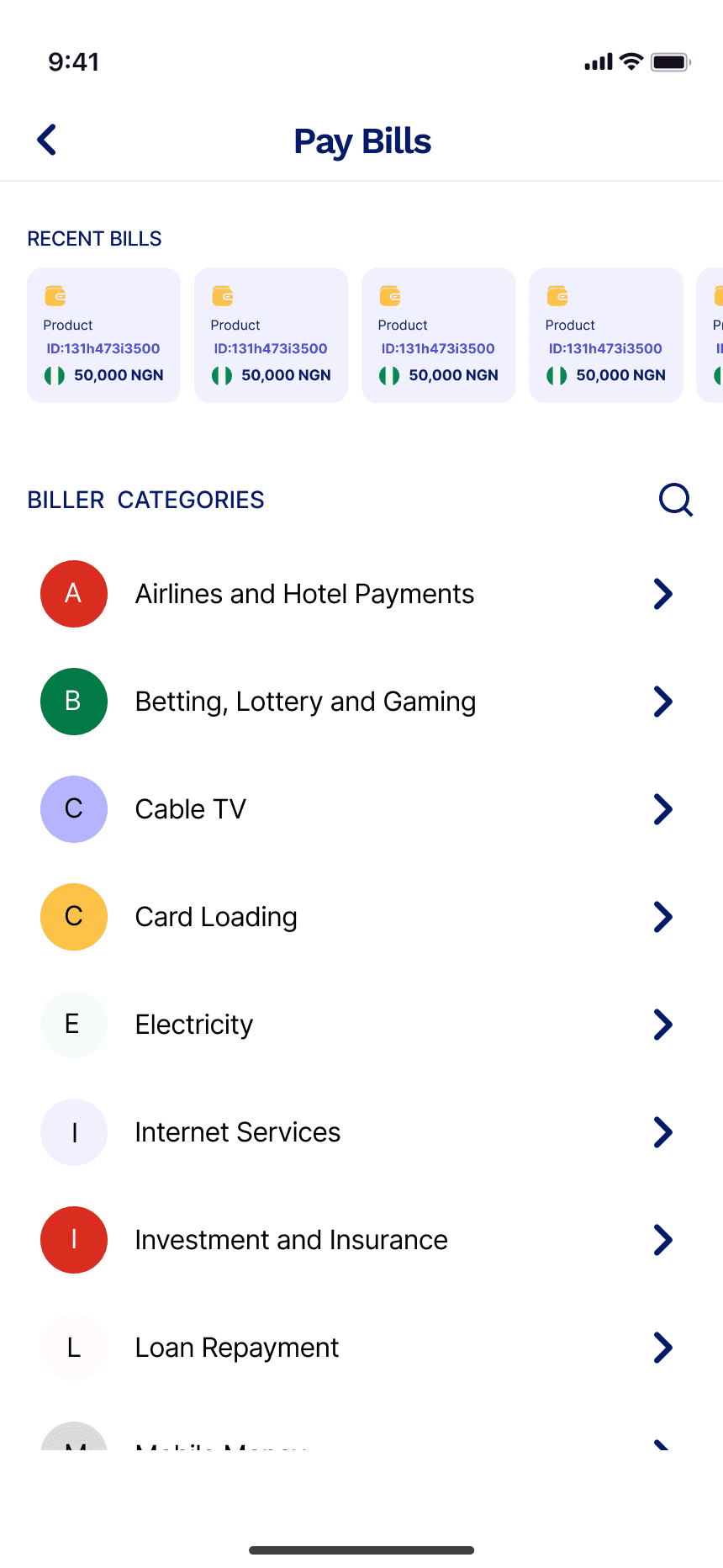

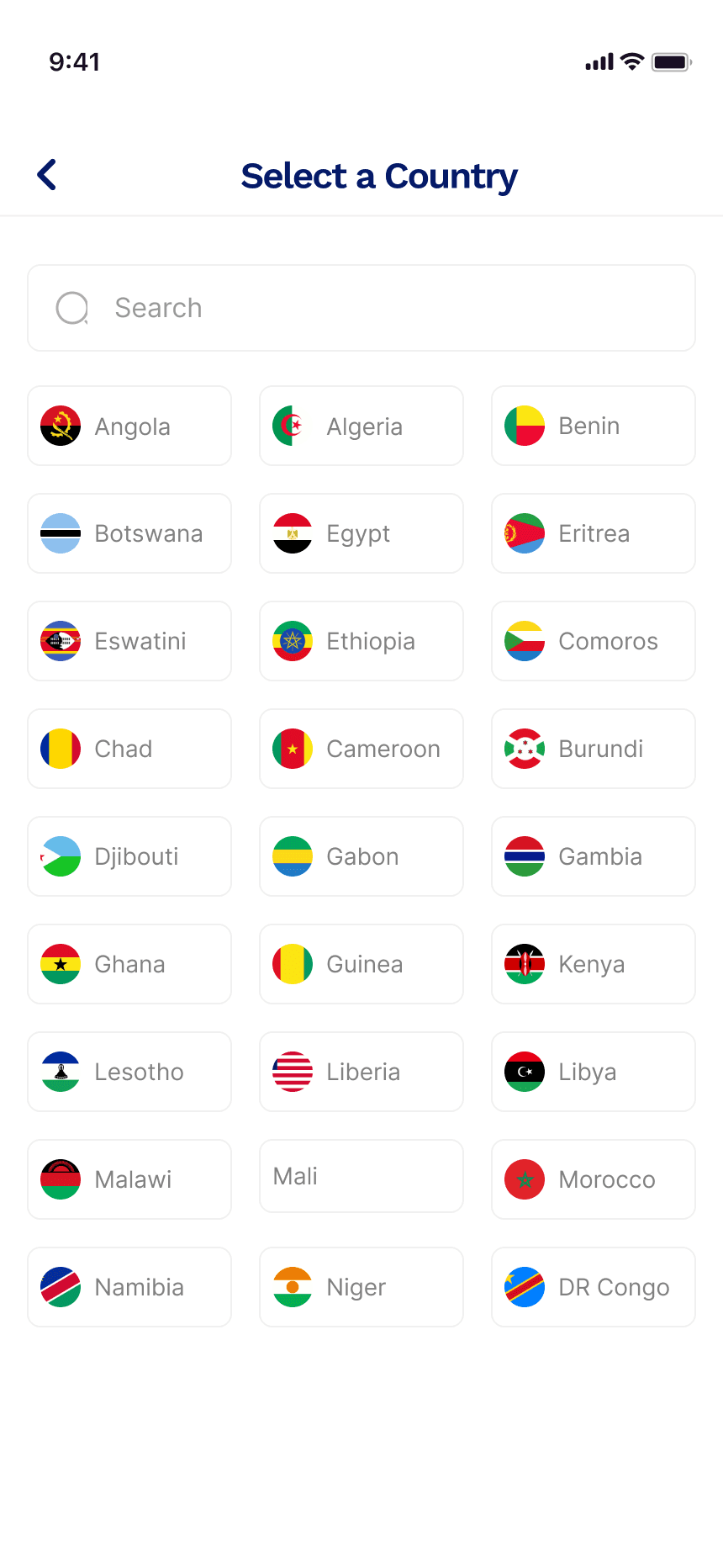

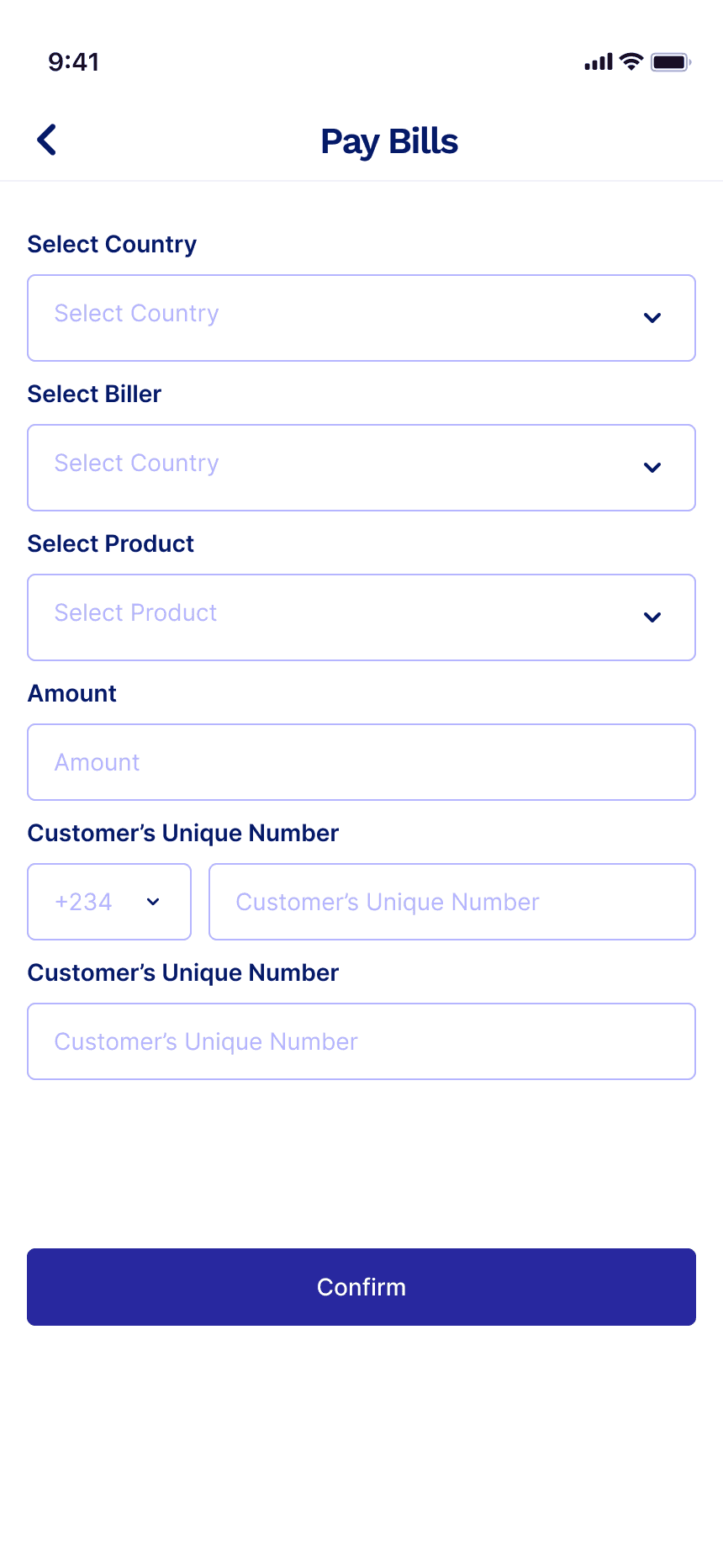

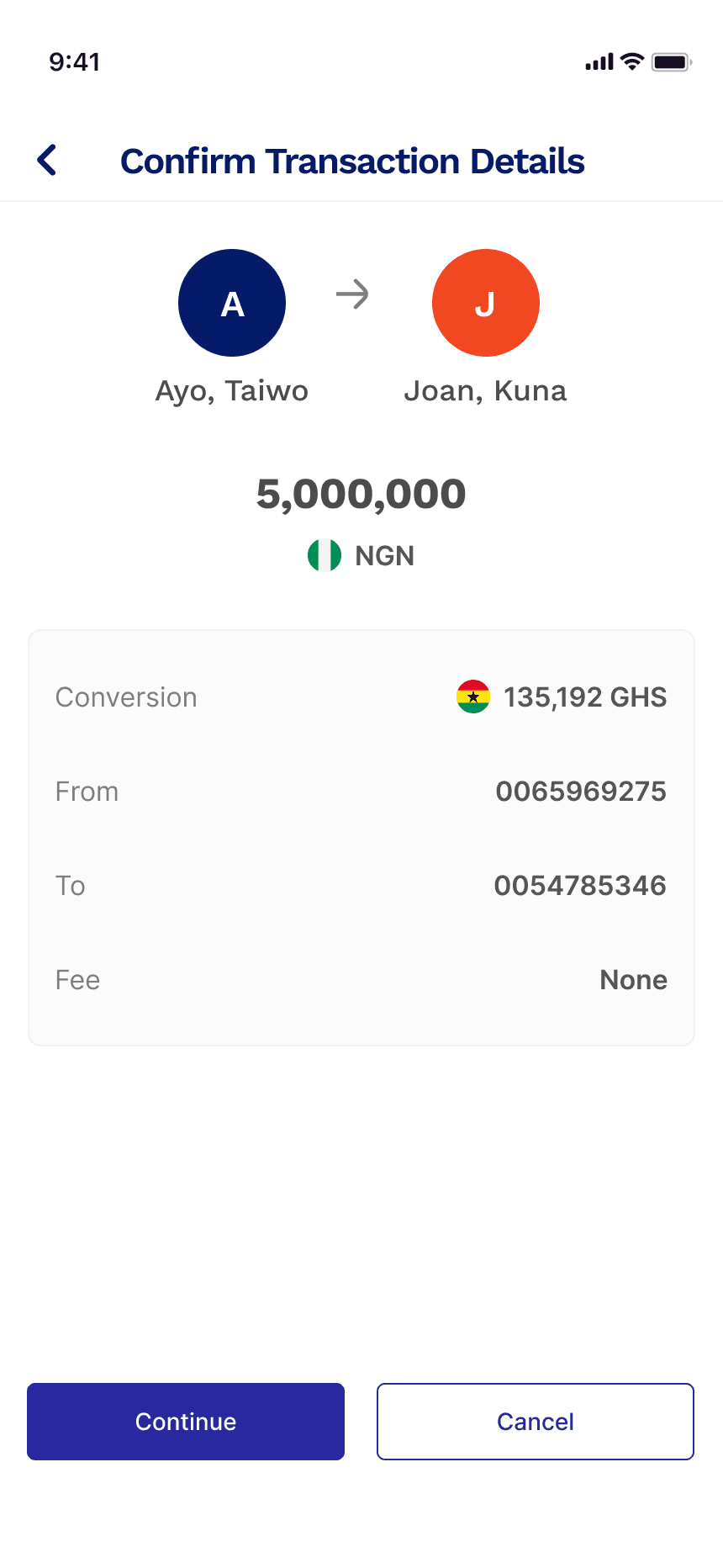

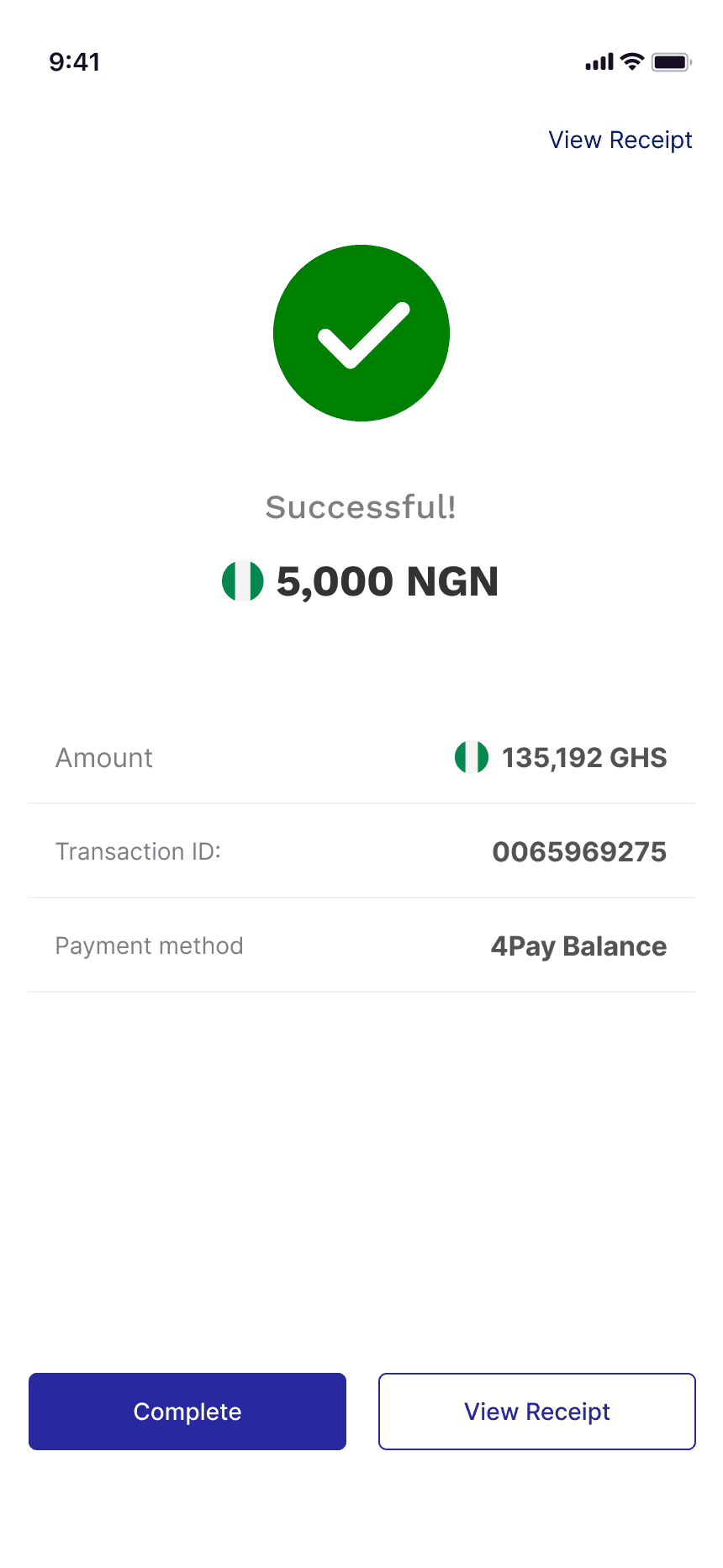

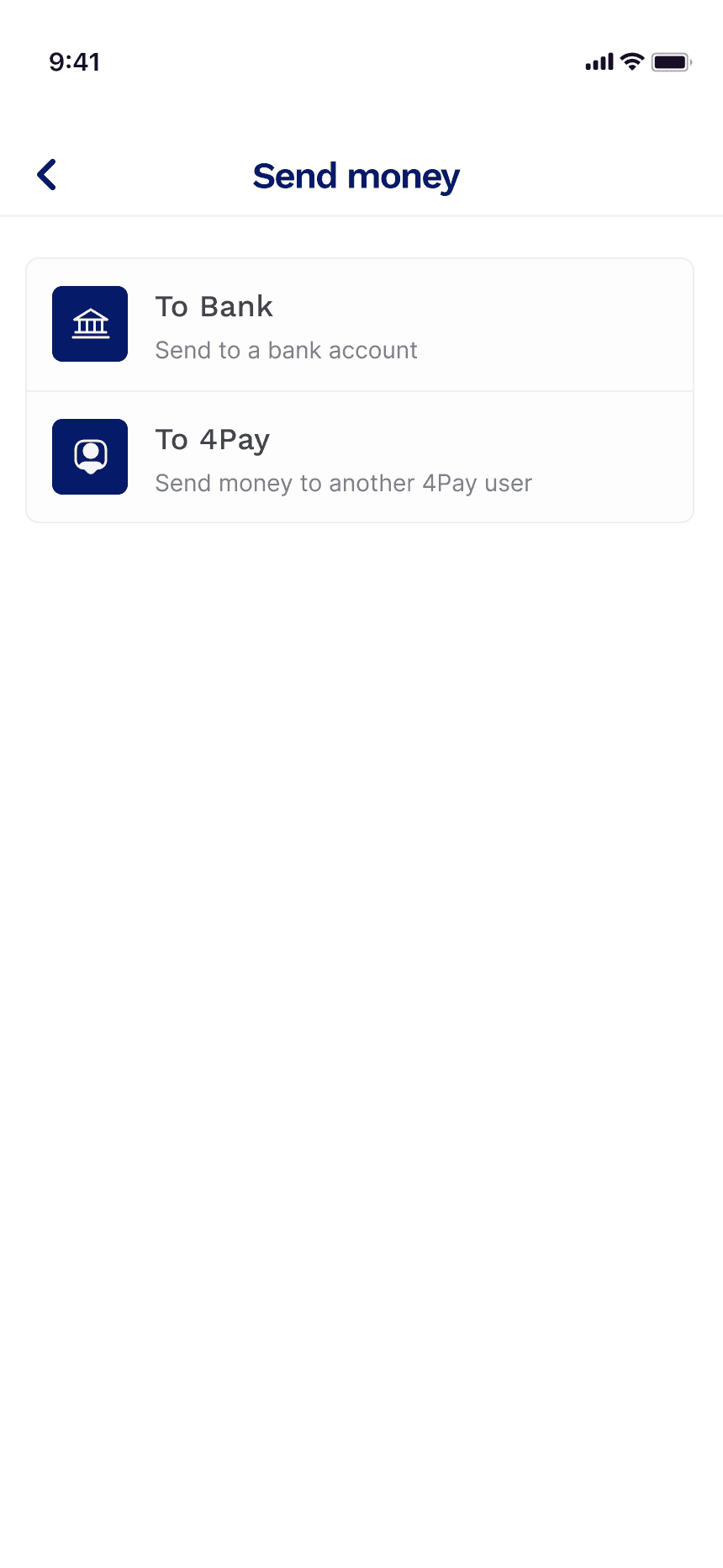

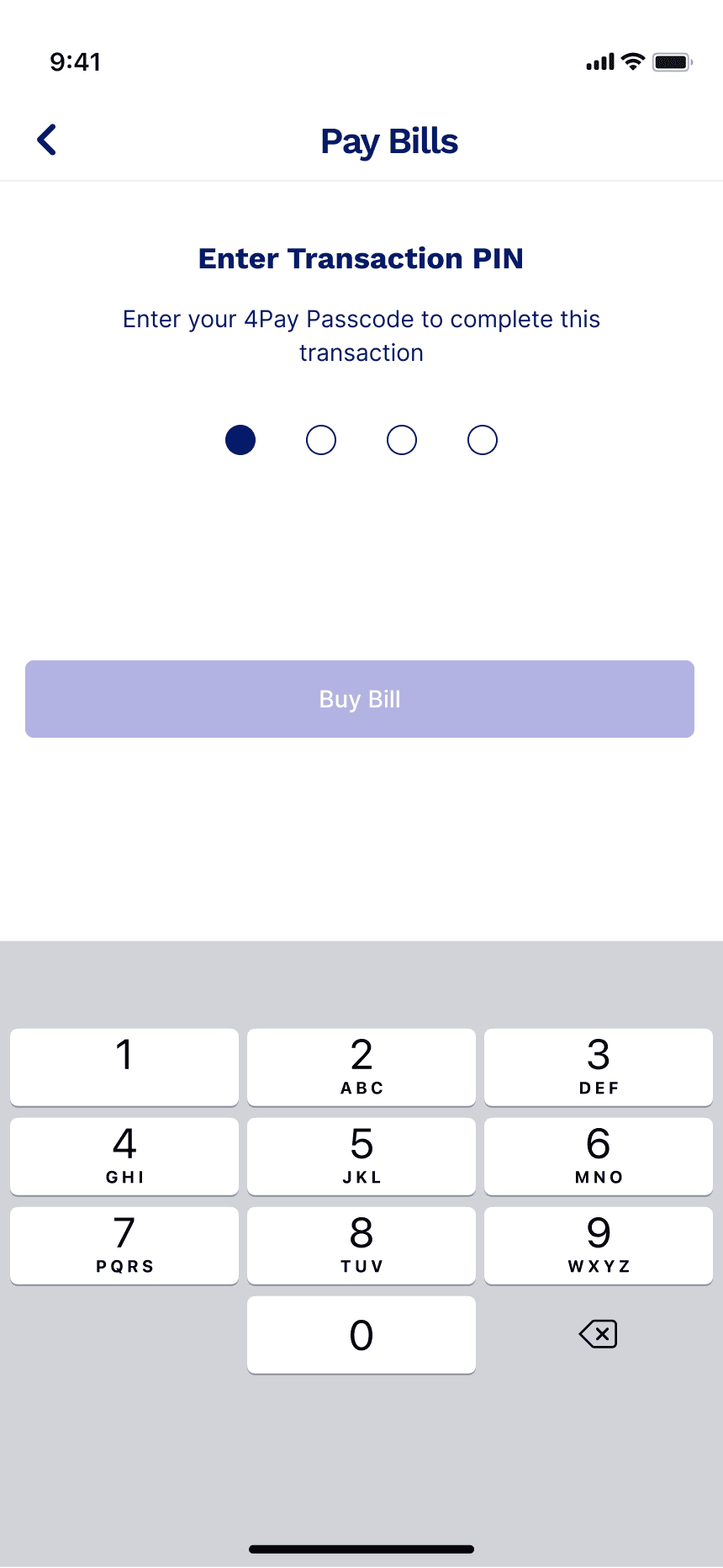

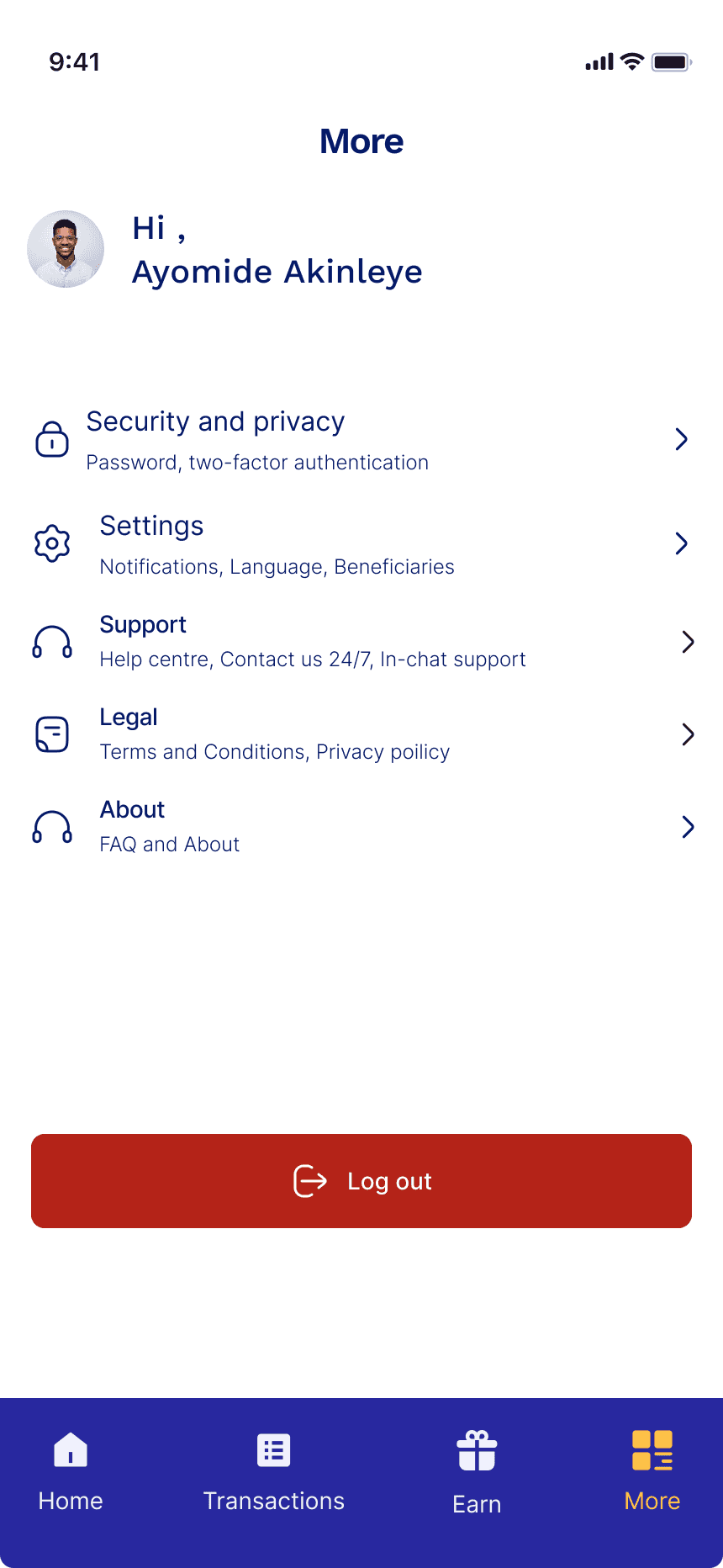

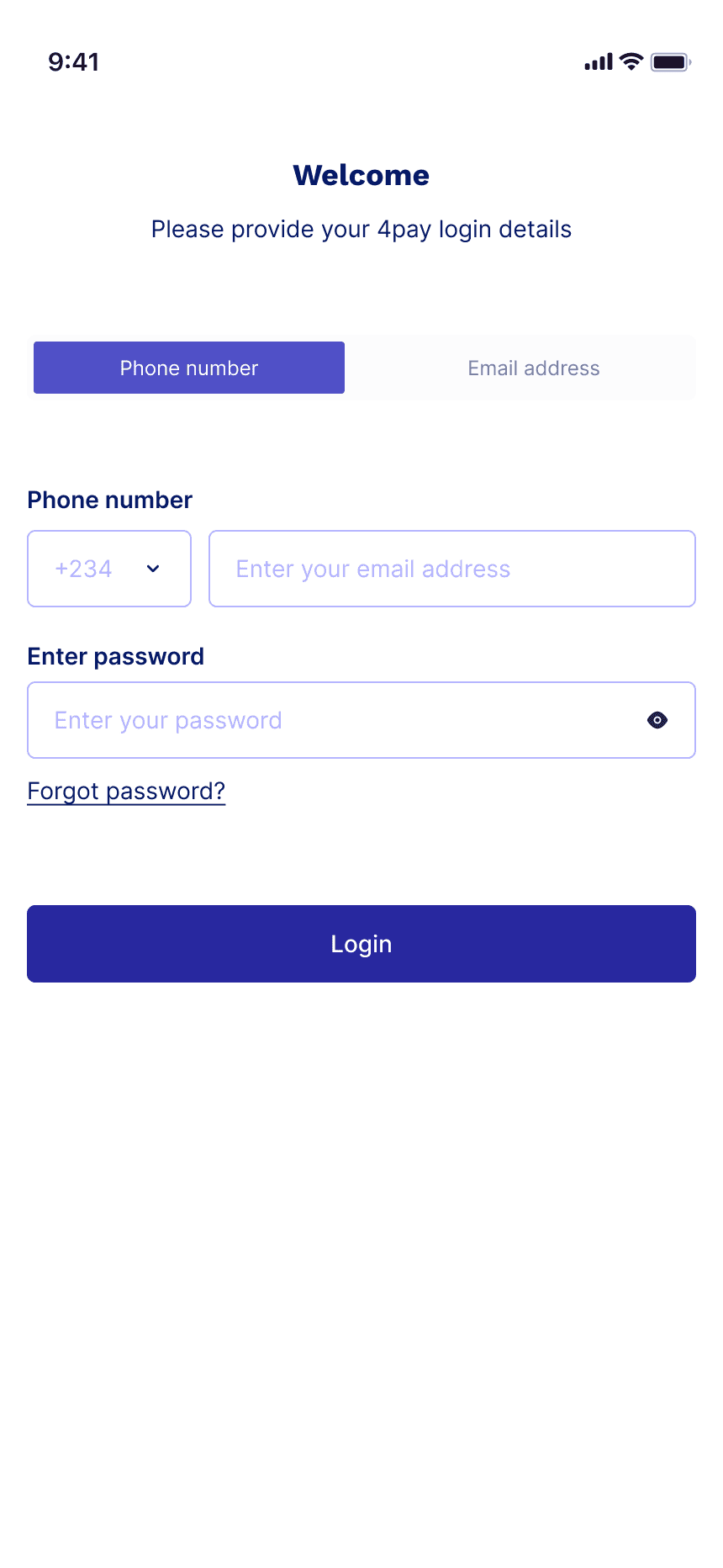

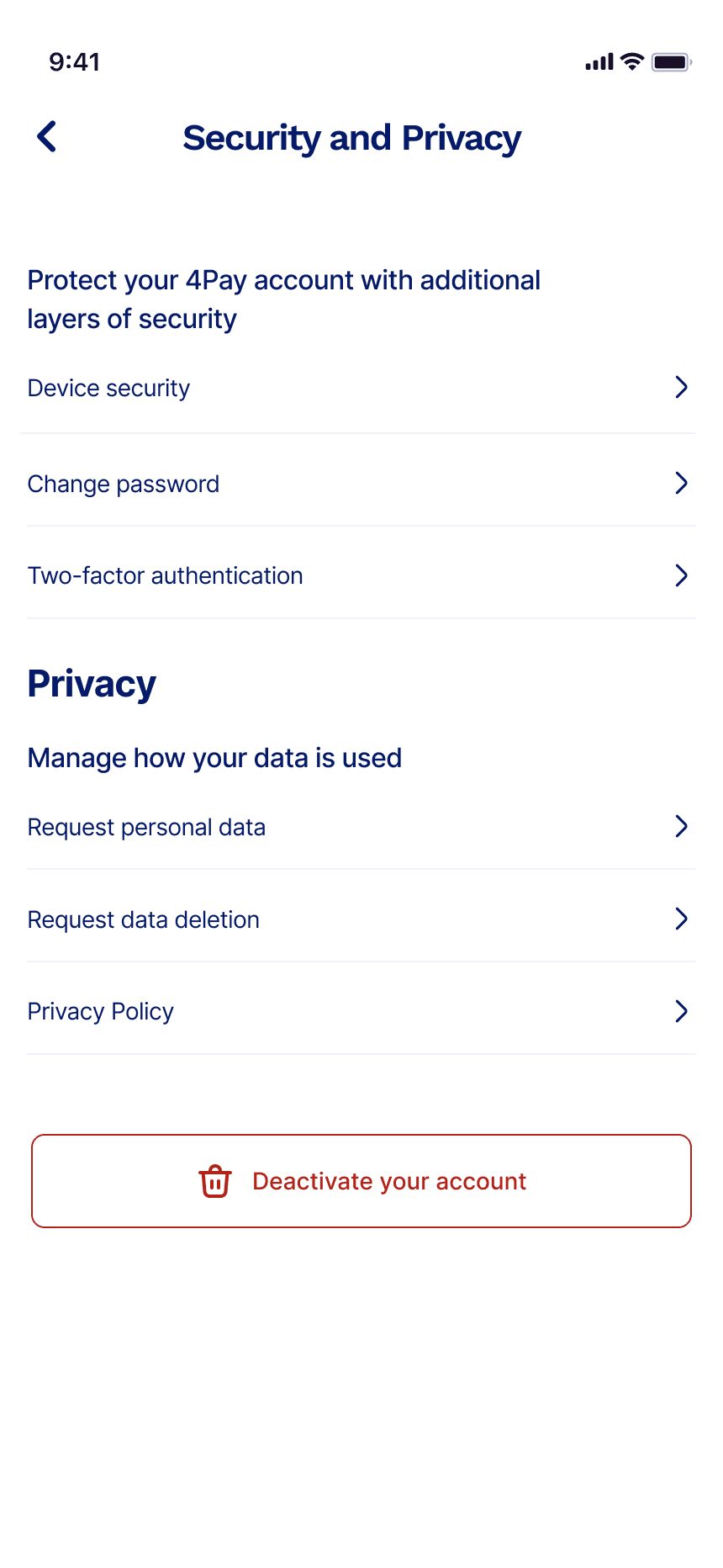

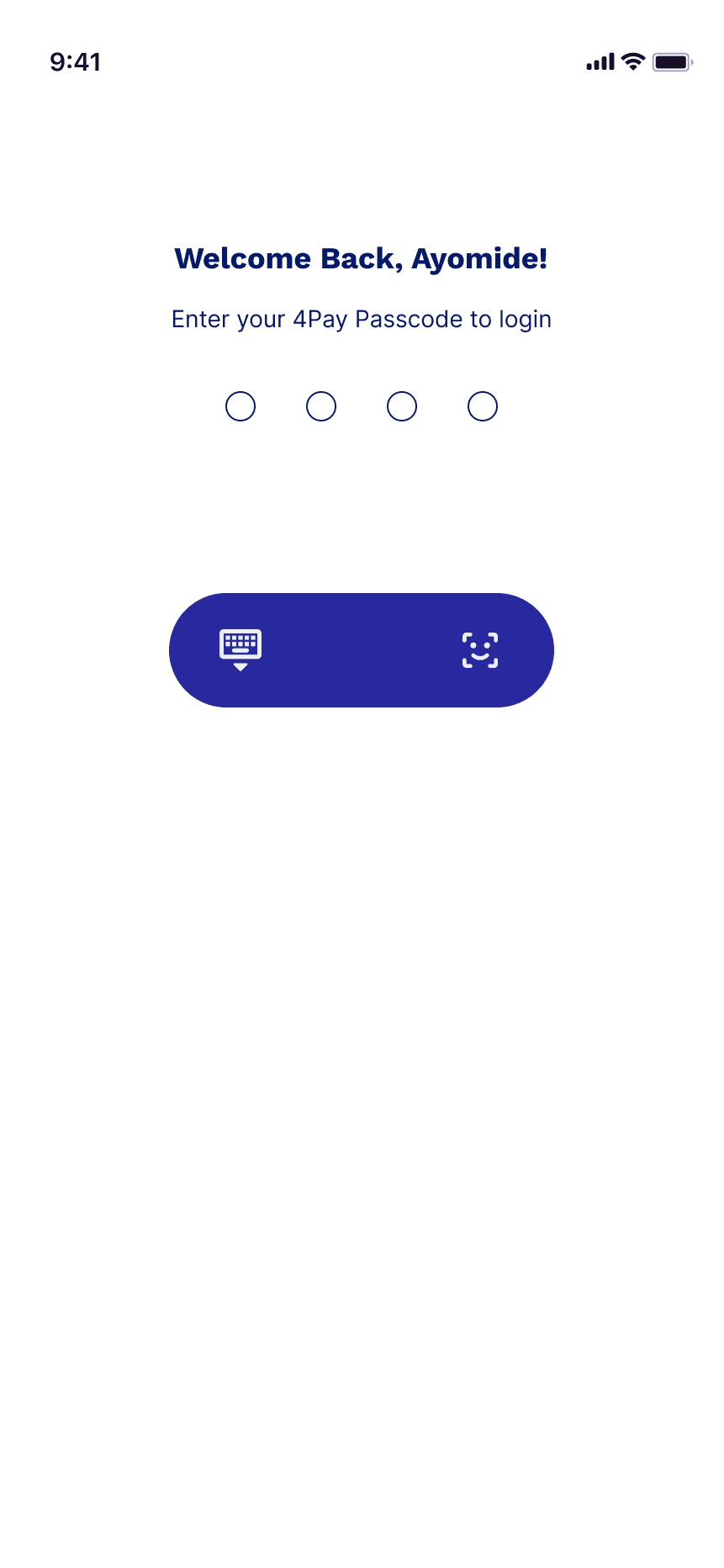

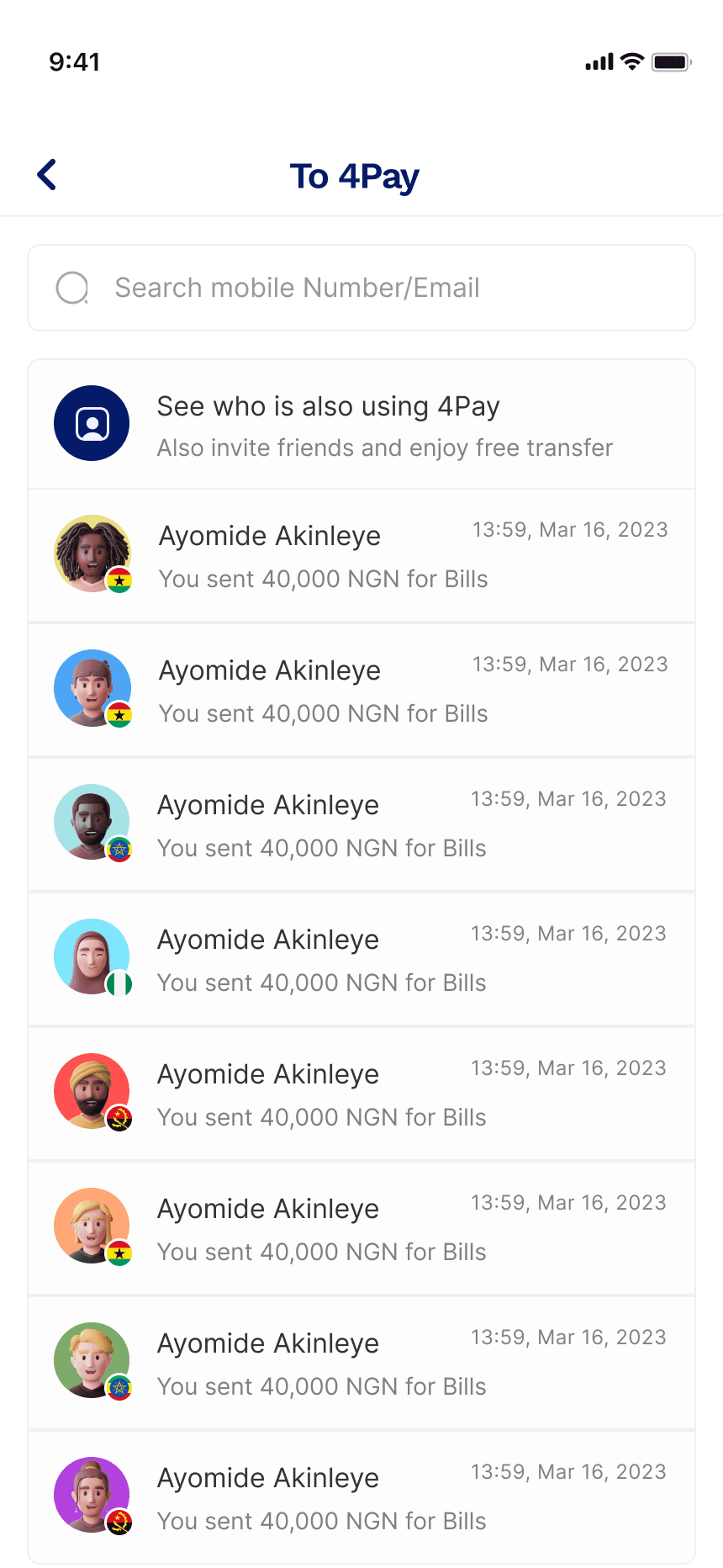

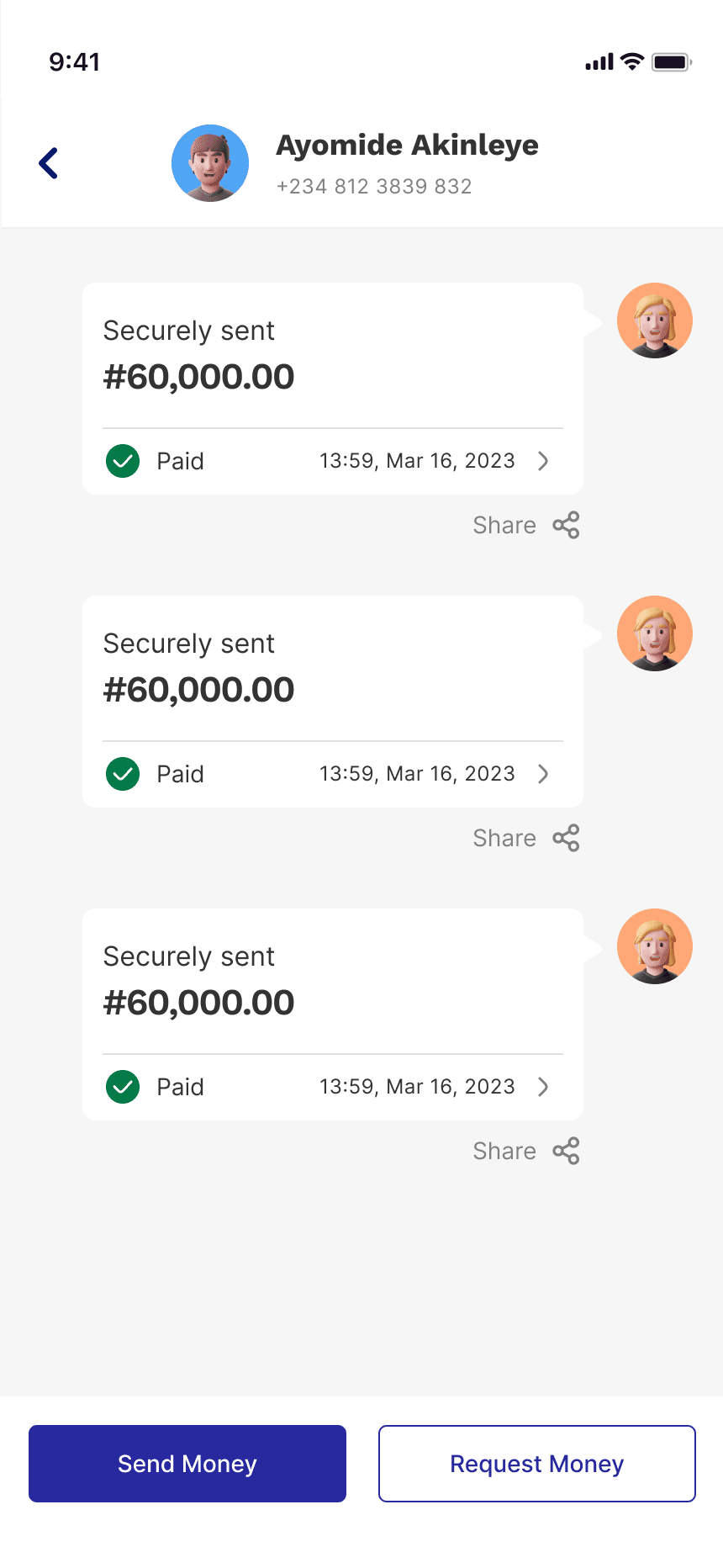

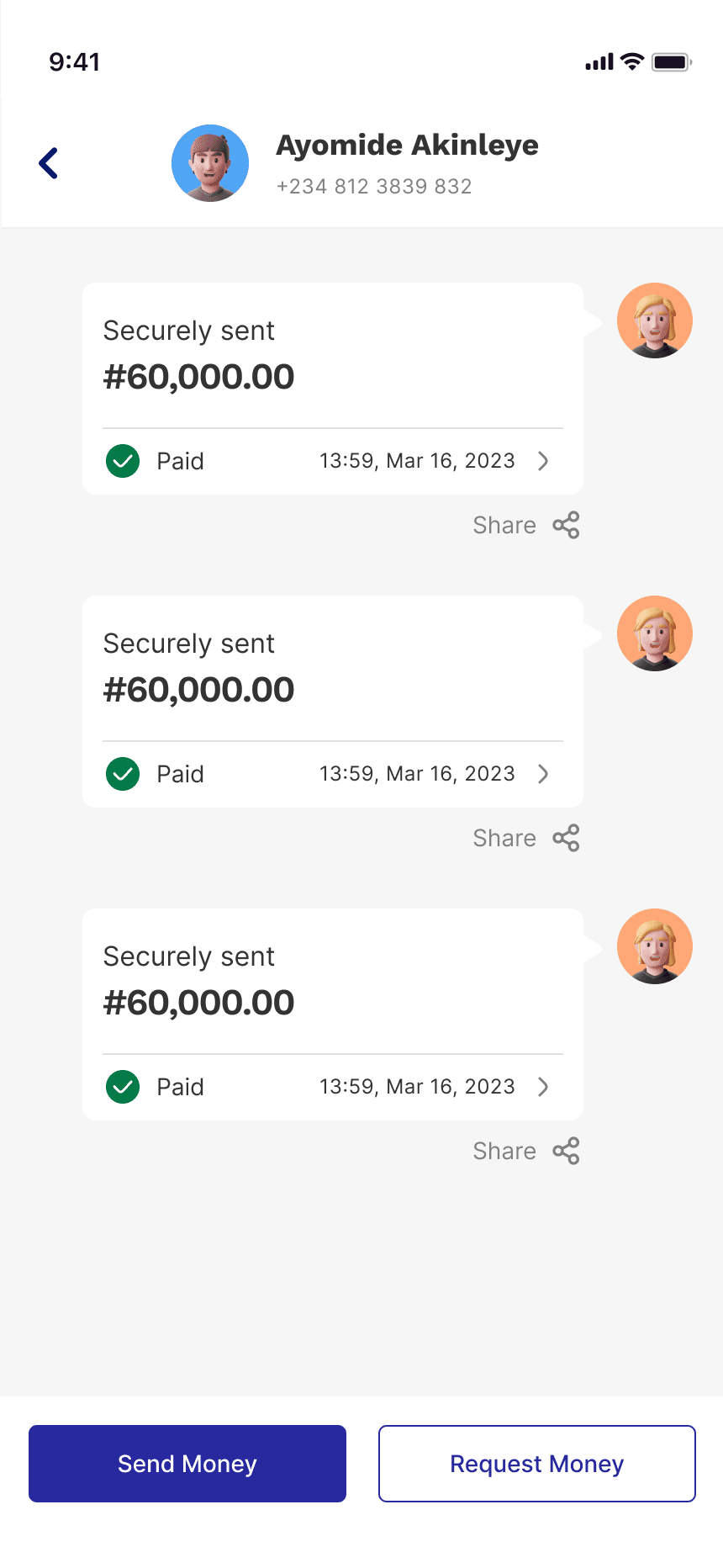

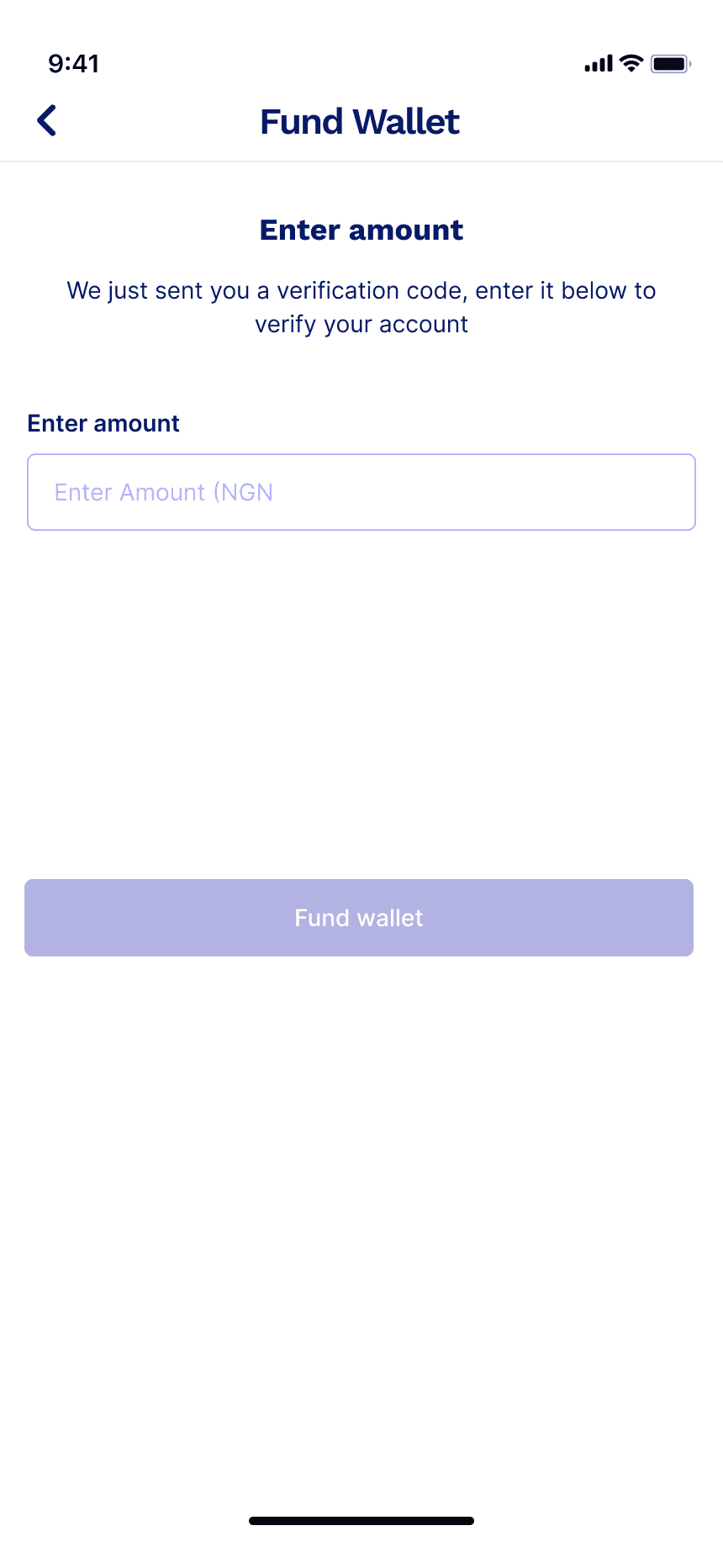

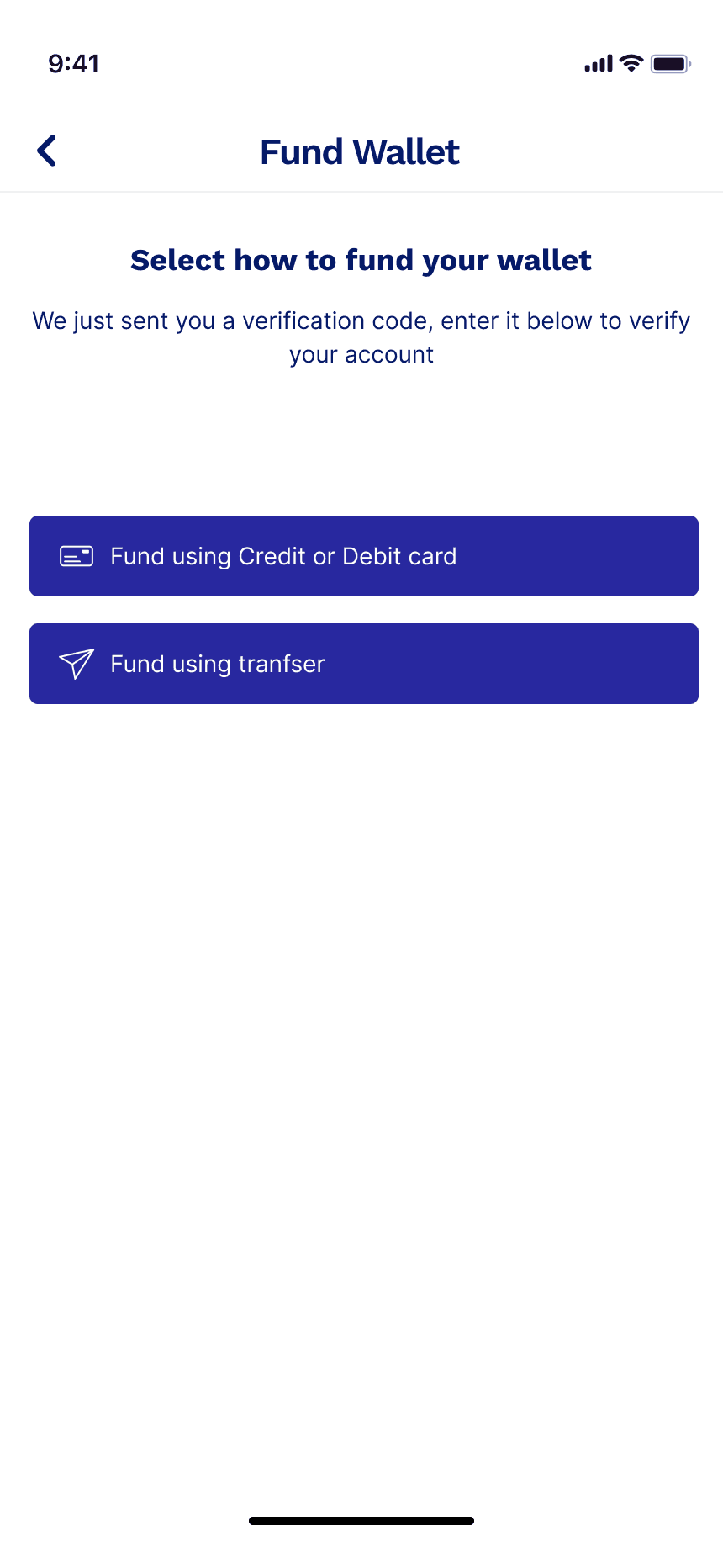

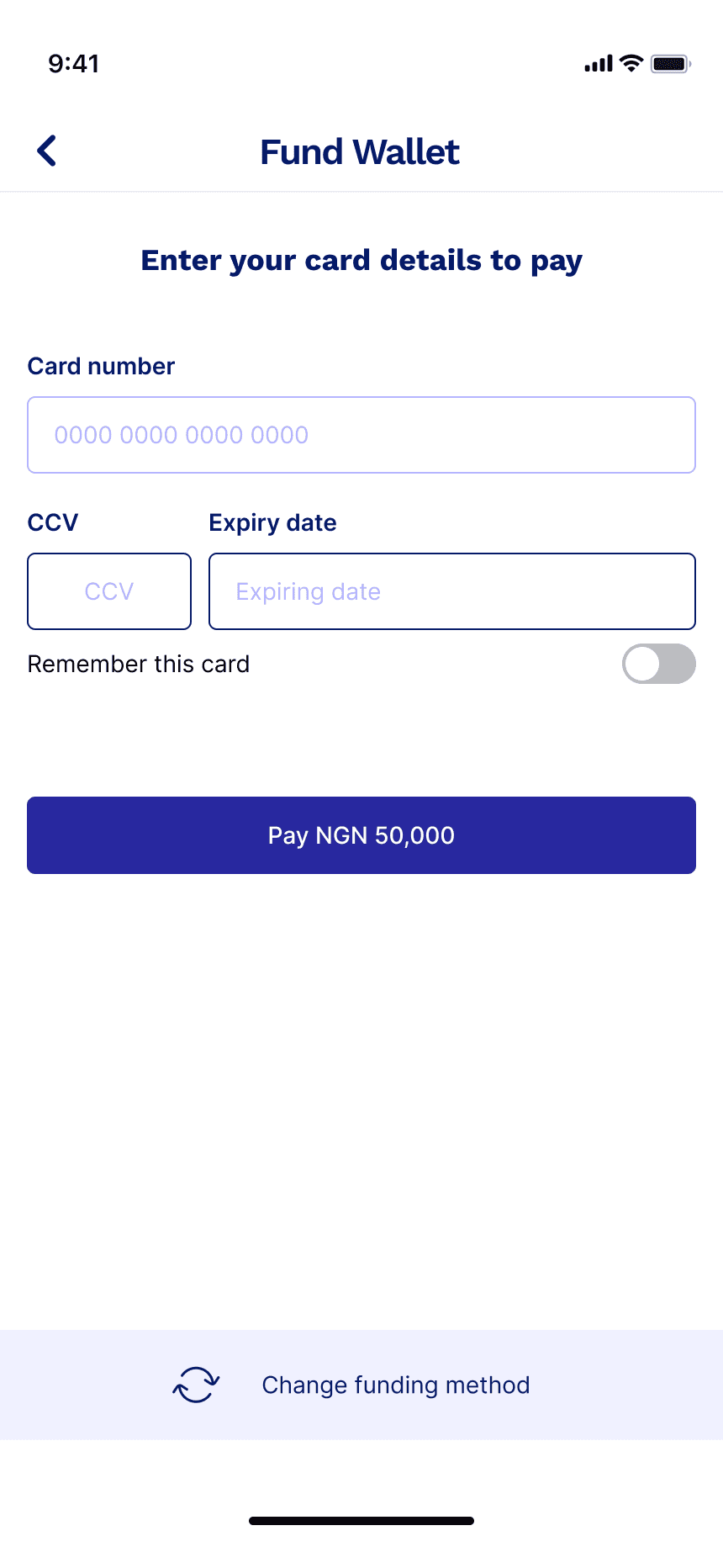

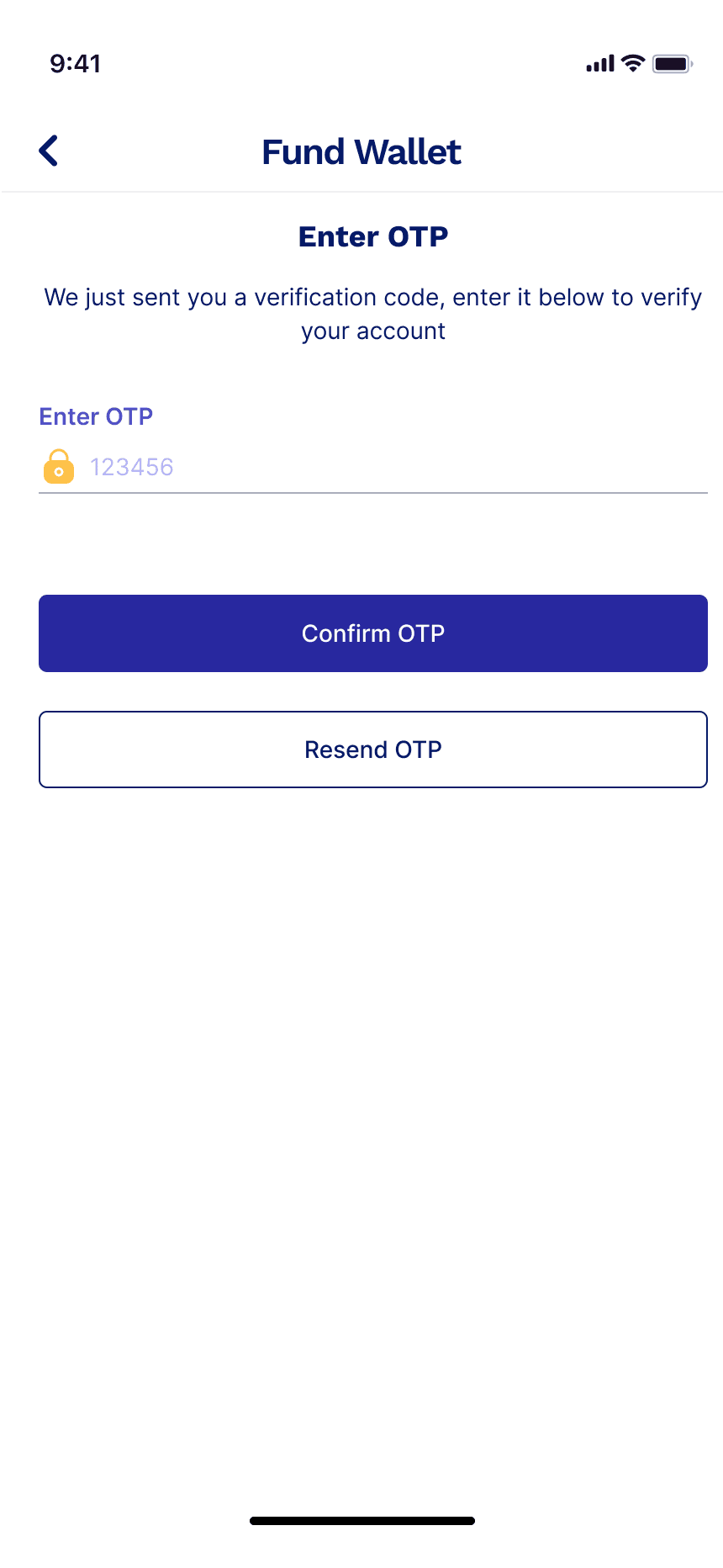

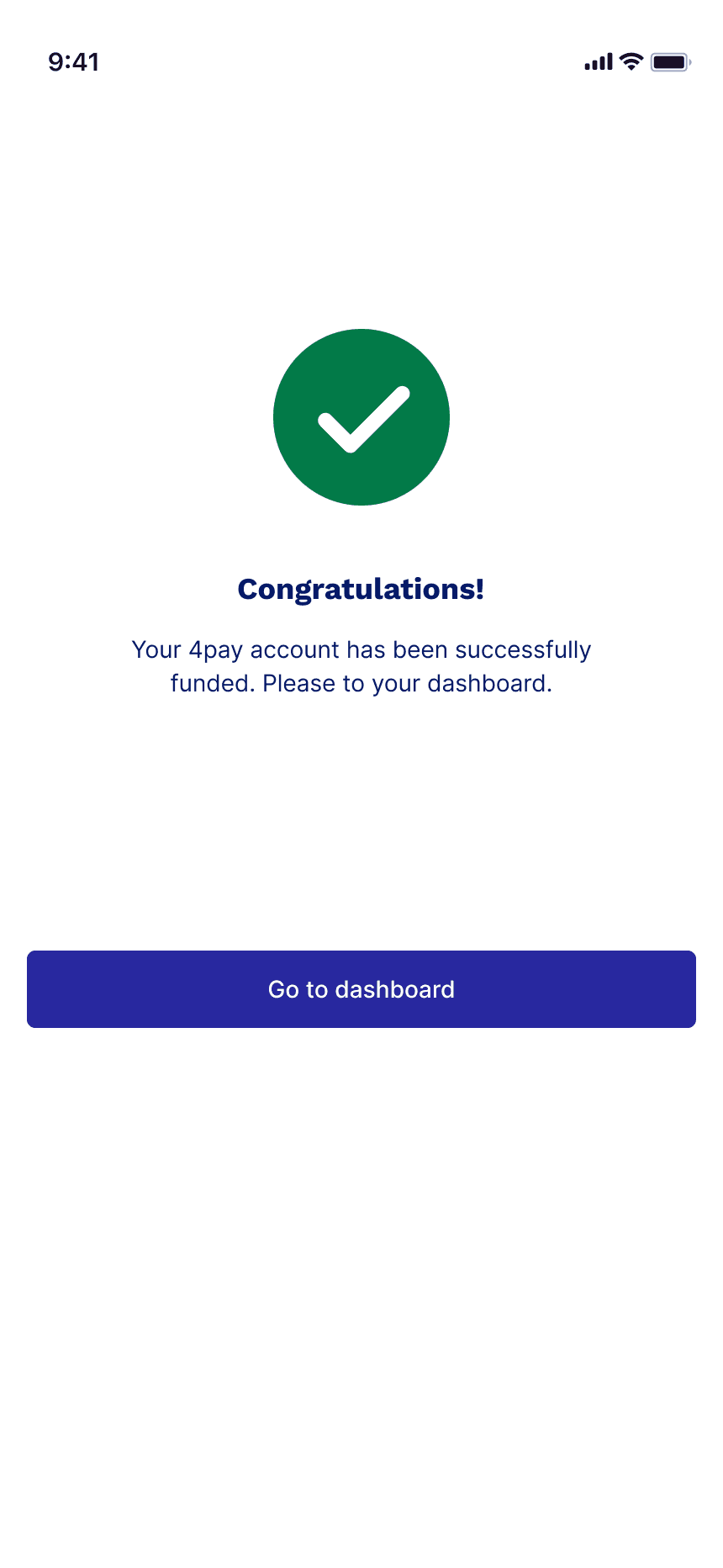

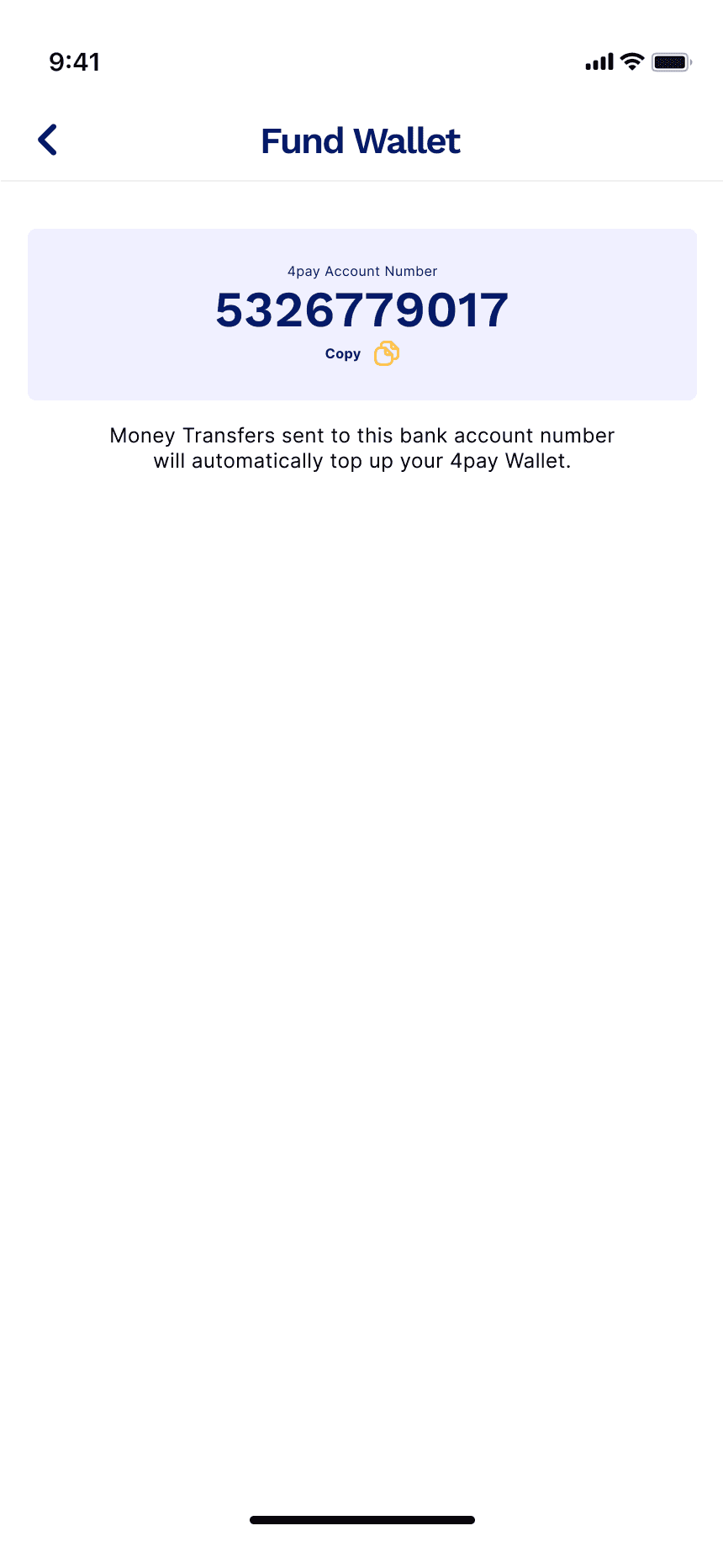

Key Features

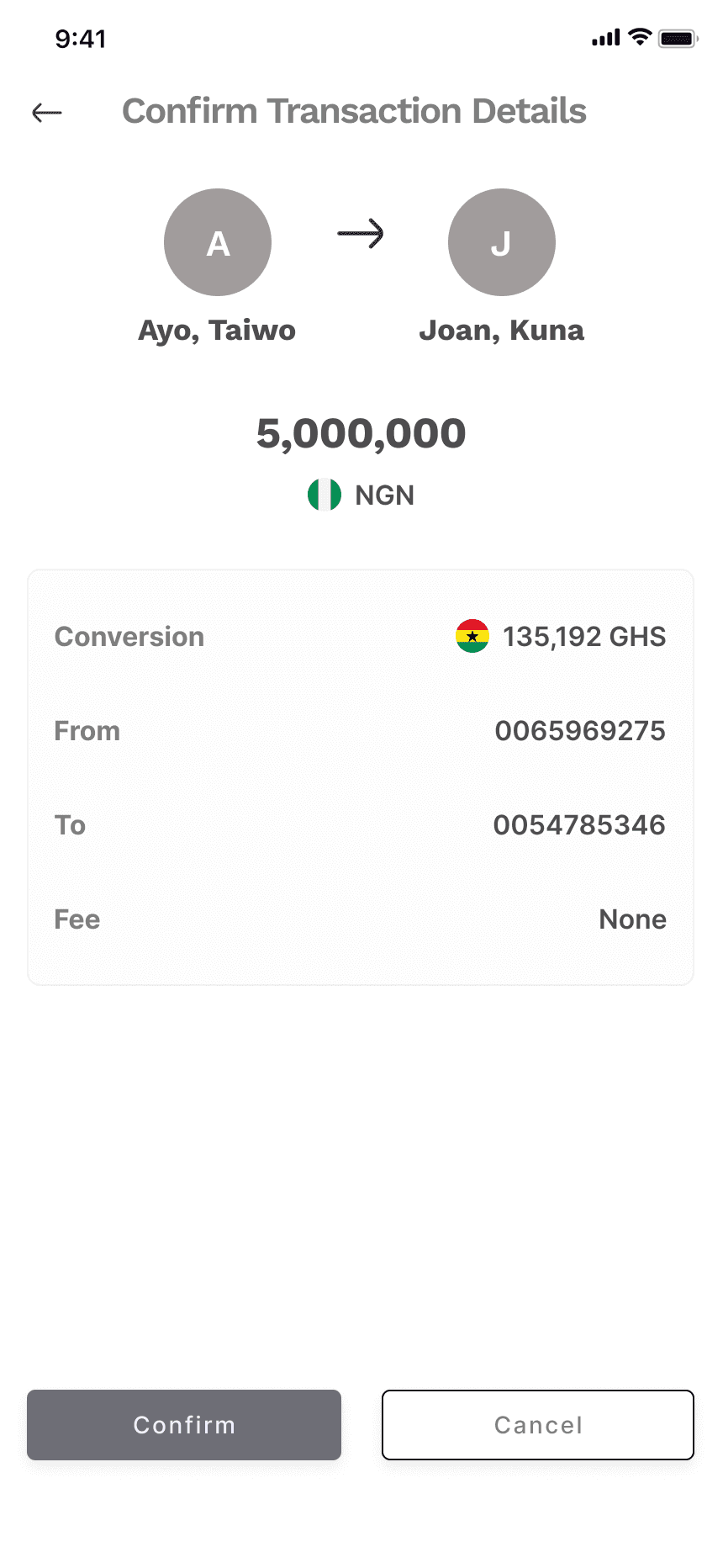

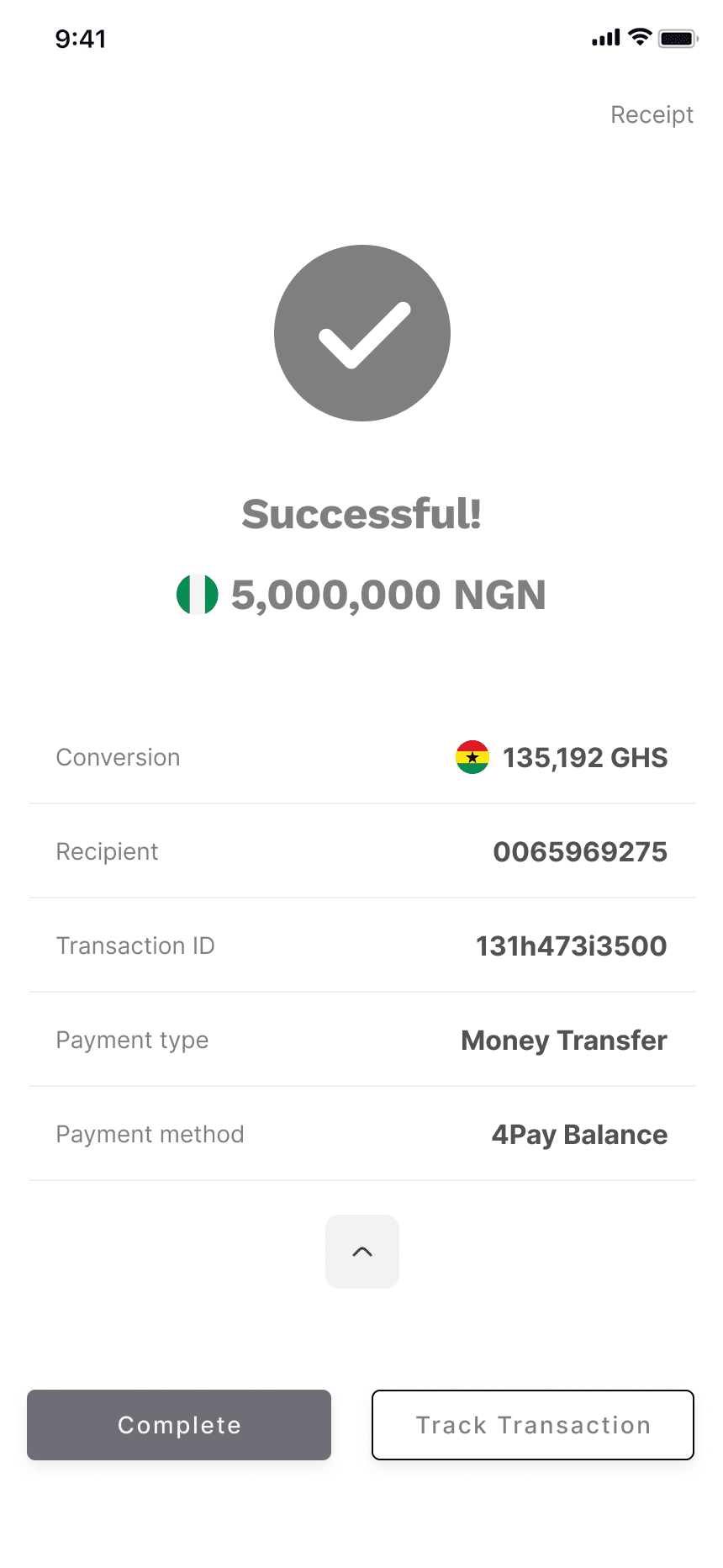

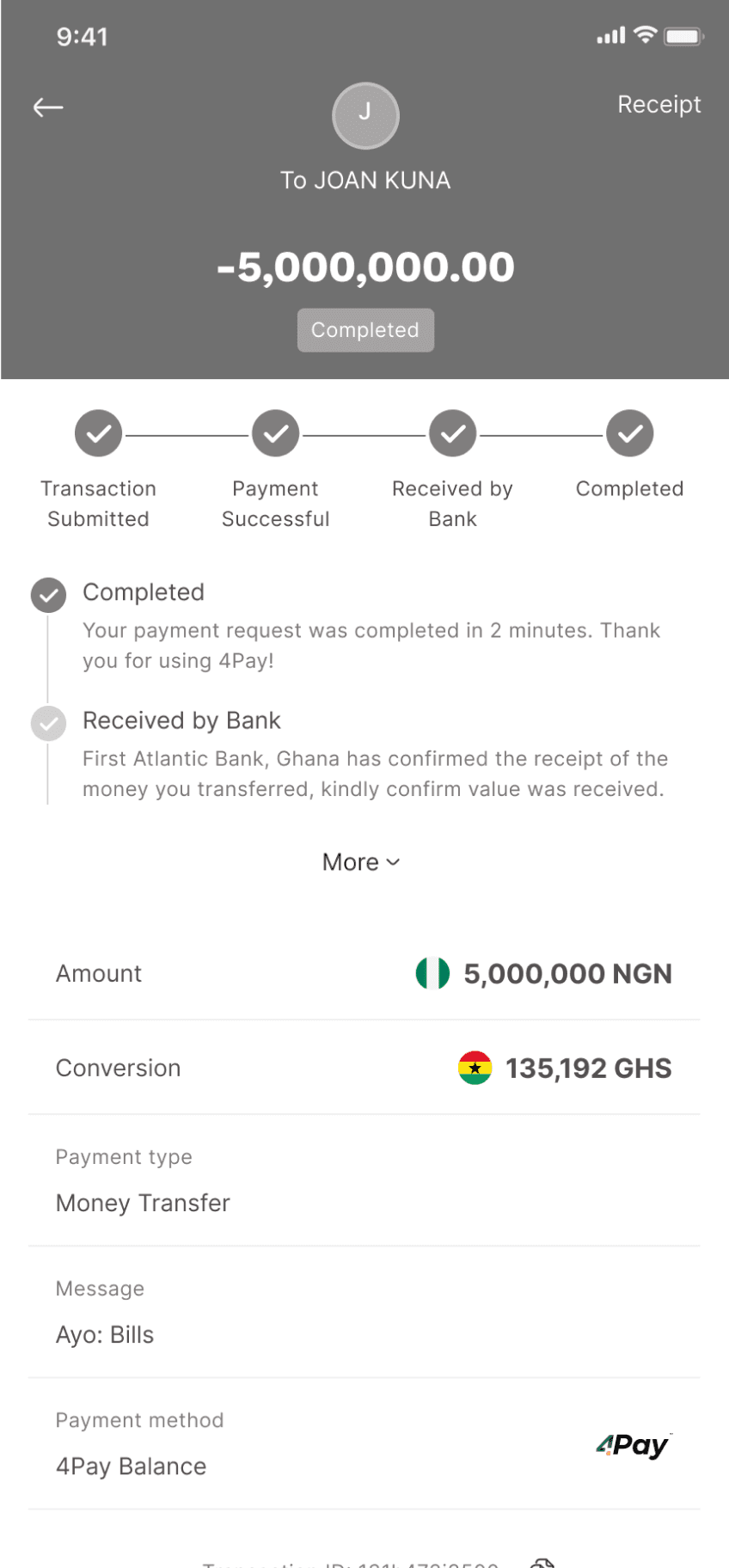

Send money

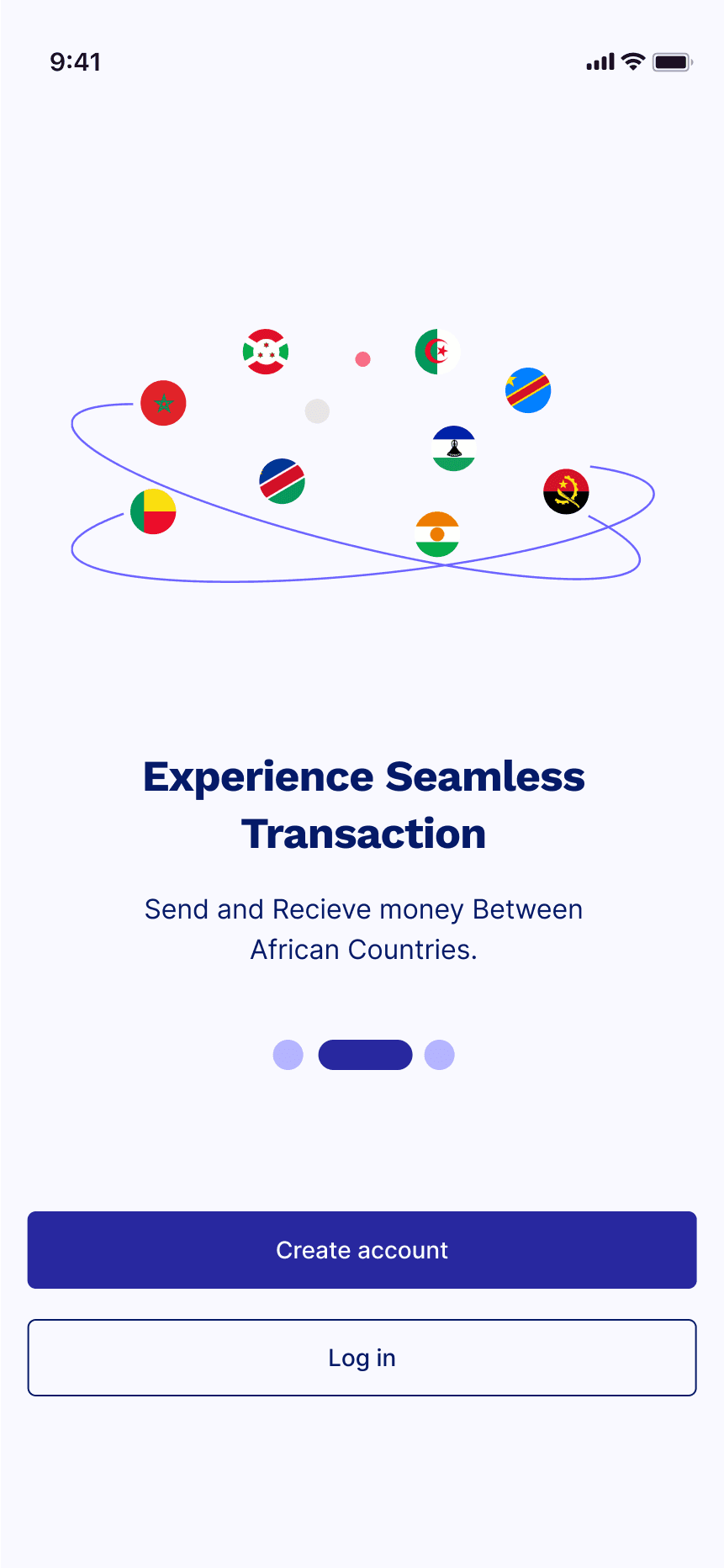

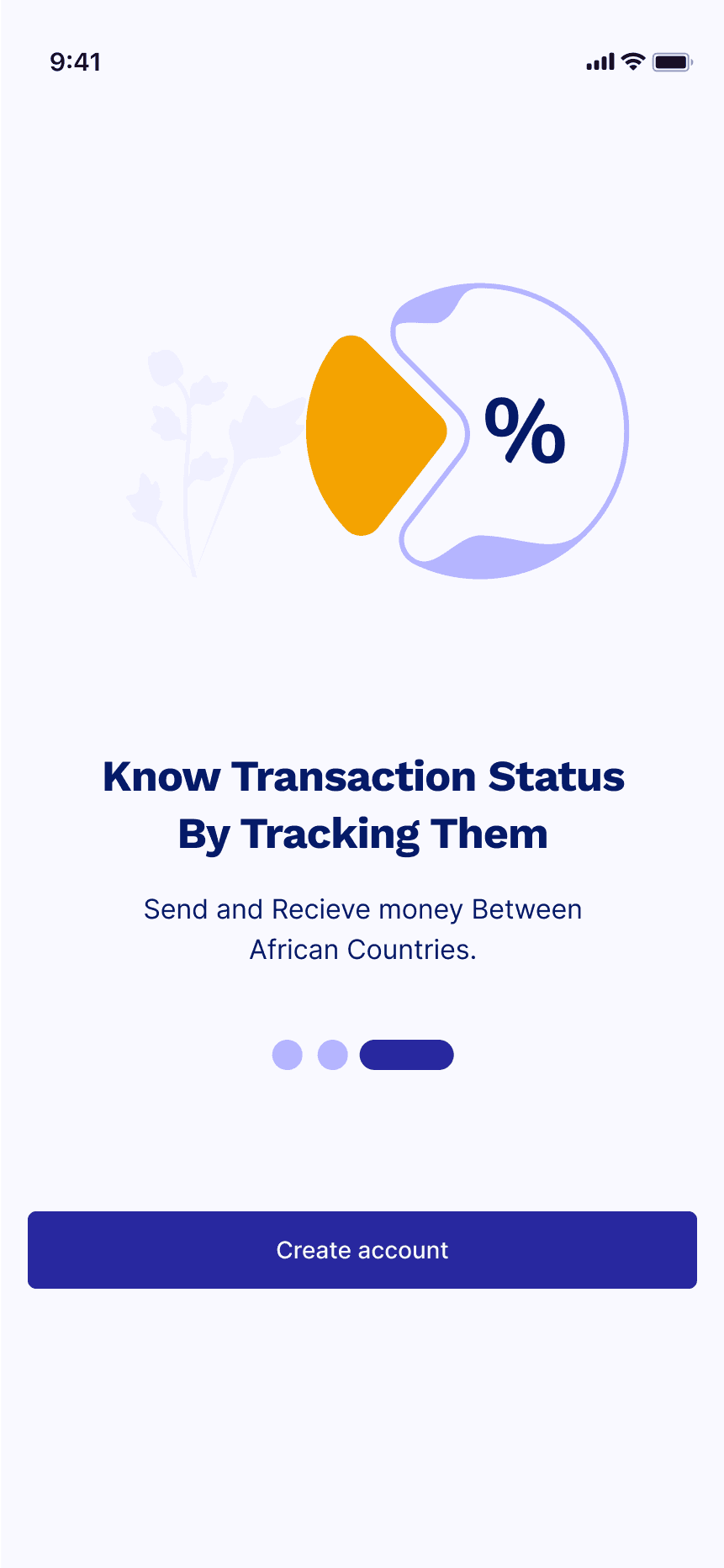

onboarding screens

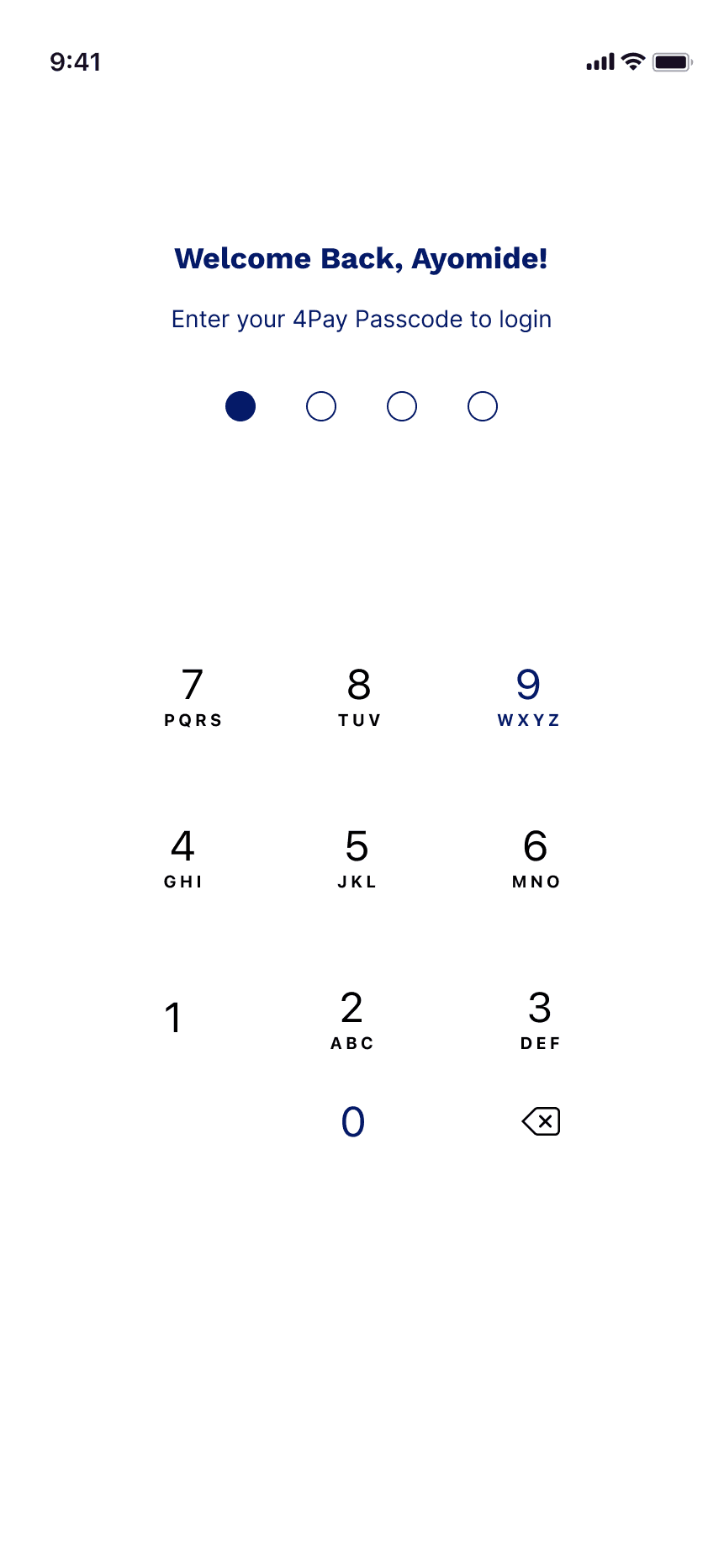

Authentication screens

Fund Wallet

More screens

Bill Payment

High-Fidelity Design

After creating lo-fi, we proceeded to high-fidelity design keeping our user interface minimal and simple for ease of use

Prototype Phase

Mark

Proposed Conclusion

Conclusion

In this case study, we embarked on the mission to revolutionise cross-border transactions in Africa. Our goal was to create a user-centric payment app that eliminates the need for currency conversion and simplifies the process.

Through empathetic research, collaboration, and innovative thinking, we identified key pain points, such as the need for flexible OTP delivery, and designed features to address them. Our user personas, like Jessica, guided the efforts to make the app easy and convenient.

While we met our project deadline, further usability testing is essential to ensure user satisfaction. We're excited about the potential of our app to transform cross-border payments, making them seamless and efficient for users across Africa.